Page 1200 - How to Make Money in Stocks Trilogy

P. 1200

Don’t Invest Blindly: Use Charts to See the Best Time to Buy and Sell 183

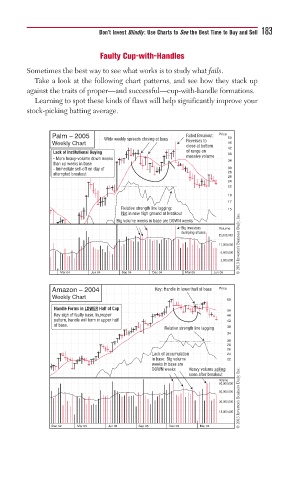

Faulty Cup-with-Handles

Sometimes the best way to see what works is to study what fails.

Take a look at the following chart patterns, and see how they stack up

against the traits of proper—and successful—cup-with-handle formations.

Learning to spot these kinds of flaws will help significantly improve your

stock-picking batting average.

Palm – 2005 Wide weekly spreads closing at lows Failed Breakout: Price 50

Weekly Chart Reverses to 46

close at bottom 42

Lack of Institutional Buying of range on

massive volume 38

- More heavy-volume down weeks

than up weeks in base 34

- Immediate sell-off on day of 30

28

attempted breakout

26

24

22

19

17

Relative strength line lagging: 15

Not in new high ground at breakout

© 2013 Investor’s Business Daily, Inc.

Big volume weeks in base are DOWN weeks

Big investors Volume

dumping shares

25,000,000

11,000,000

6,000,000

3,000,000

Mar 04 Jun 04 Sep 04 Dec 04 Mar 05 Jun 05

Amazon – 2004 Key: Handle in lower half of base Price

Weekly Chart

60

Handle Forms in LOWER Half of Cup 50

Key sign of faulty base. In proper 46

pattern, handle will form in upper half 42

of base.

Relative strength line lagging 38

34

30

28

26

Lack of accumulation 24

in base: Big volume 22

weeks in base are

© 2013 Investor’s Business Daily, Inc.

DOWN weeks Heavy volume selling

soon after breakout

Volume

80,000,000

50,000,000

30,000,000

18,000,000

Dec 02 Mar 03 Jun 03 Sep 03 Dec 03 Mar 04