Page 1204 - How to Make Money in Stocks Trilogy

P. 1204

Don’t Invest Blindly: Use Charts to See the Best Time to Buy and Sell 187

Double Bottom

Second Most Common Pattern

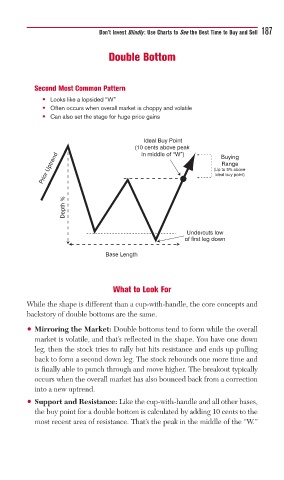

• Looks like a lopsided “W”

• Often occurs when overall market is choppy and volatile

• Can also set the stage for huge price gains

Ideal Buy Point

(10 cents above peak Buying

Prior Uptrend (Up to 5% above

in middle of “W”)

Range

ideal buy point)

Depth %

Undercuts low

of first leg down

Base Length

What to Look For

While the shape is different than a cup-with-handle, the core concepts and

backstory of double bottoms are the same.

• Mirroring the Market: Double bottoms tend to form while the overall

market is volatile, and that’s reflected in the shape. You have one down

leg, then the stock tries to rally but hits resistance and ends up pulling

back to form a second down leg. The stock rebounds one more time and

is finally able to punch through and move higher. The breakout typically

occurs when the overall market has also bounced back from a correction

into a new uptrend.

• Support and Resistance: Like the cup-with-handle and all other bases,

the buy point for a double bottom is calculated by adding 10 cents to the

most recent area of resistance. That’s the peak in the middle of the “W.”