Page 1219 - How to Make Money in Stocks Trilogy

P. 1219

202 HOW TO MAKE MONEY IN STOCKS—GETTING STARTED

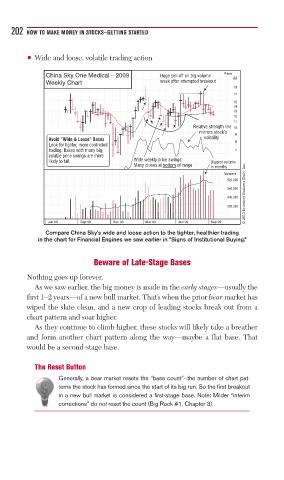

• Wide and loose, volatile trading action

China Sky One Medical – 2009 Huge sell-off on big volume Price 22

Weekly Chart week after attempted breakout

19

17

15

14

13

12

11

Relative strength line 10

mirrors stock’s 9

Avoid “Wide & Loose” Bases volatility 8

Look for tighter, more controlled

trading. Bases with many big, 7

volatile price swings are more

likely to fail. Wide weekly price swings: Biggest volume

Many closes at bottom of range in months

© 2013 Investor’s Business Daily, Inc.

Volume

920,000

560,000

340,000

200,000

Jun 08 Sep 08 Dec 08 Mar 09 Jun 09 Sep 09

Compare China Sky’s wide and loose action to the tighter, healthier trading

in the chart for Financial Engines we saw earlier in “Signs of Institutional Buying.”

Beware of Late-Stage Bases

Nothing goes up forever.

As we saw earlier, the big money is made in the early stages—usually the

first 1–2 years—of a new bull market. That’s when the prior bear market has

wiped the slate clean, and a new crop of leading stocks break out from a

chart pattern and soar higher.

As they continue to climb higher, these stocks will likely take a breather

and form another chart pattern along the way—maybe a flat base. That

would be a second-stage base.

The Reset Button

Generally, a bear market resets the “base count”—the number of chart pat-

terns the stock has formed since the start of its big run. So the first breakout

in a new bull market is considered a first-stage base. Note: Milder “interim

corrections” do not reset the count (Big Rock #1, Chapter 3).