Page 1214 - How to Make Money in Stocks Trilogy

P. 1214

Don’t Invest Blindly: Use Charts to See the Best Time to Buy and Sell 197

Mirroring the Market Once Again

Just as double bottoms typically form when the overall market is volatile,

base-on-base patterns often appear when there is uncertainty or significant

selling pressure.

You’ll see stocks make that initial breakout from the prior pattern, but

then the overall market weakens and they quickly pull back to form that sec-

ond base.

The good news is, once the heavy “weight” of a market downturn or sell-

ing pressure is removed, leading stocks break out from these base-on-base

and other patterns and quickly spring higher to new gains.

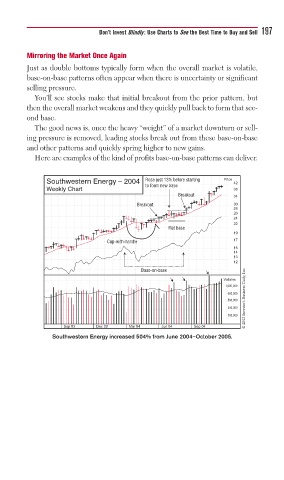

Here are examples of the kind of profits base-on-base patterns can deliver.

Southwestern Energy – 2004 Rose just 13% before starting Price 42

to form new base

Weekly Chart 38

Breakout 34

Breakout 30

28

26

24

22

Flat base

19

Cup-with-handle 17

15

14

13

12

© 2013 Investor’s Business Daily, Inc.

Base-on-base

Volume

1,600,000

960,000

580,000

340,000

200,000

Sep 03 Dec 03 Mar 04 Jun 04 Sep 04

Southwestern Energy increased 504% from June 2004–October 2005.