Page 1216 - How to Make Money in Stocks Trilogy

P. 1216

Don’t Invest Blindly: Use Charts to See the Best Time to Buy and Sell 199

Go Beyond Just the Shapes

Once you spot the shape of a chart pattern, also look for signs of “accumu-

lation” (institutional buying) and support within the base. That’s how you

separate sound patterns from potentially faulty ones.

This comes back to Big Rock #3 we discussed earlier: Buy stocks being

heavily bought by institutional investors. Avoid those they're heavily selling.

Look for “Clues” in the Daily Stock Analysis Videos

Regularly watching these free videos in the IBD TV section of

Investors.com is an easy way to improve your chart-reading skills. See how

at www.investors.com/GettingStartedBook.

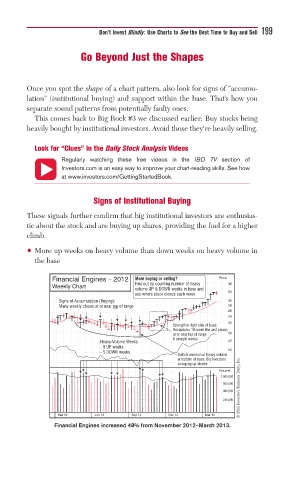

Signs of Institutional Buying

These signals further confirm that big institutional investors are enthusias-

tic about the stock and are buying up shares, providing the fuel for a higher

climb.

• More up weeks on heavy volume than down weeks on heavy volume in

the base

Financial Engines – 2012 More buying or selling? Price

Weekly Chart Find out by counting number of heavy 38

volume UP & DOWN weeks in base and

see where stock closes each week. 34

Signs of Accumulation (Buying): 30

Many weekly closes at or near top of range 28

26

24

22

Strength in right side of base:

Recaptures 10-week line and closes

at or near top of range 19

6 straight weeks

Heavy-Volume Weeks 17

- 9 UP weeks

- 5 DOWN weeks 15

Bullish reversal on heavy volume

© 2013 Investor’s Business Daily, Inc.

at bottom of base: Big investors

scooping up shares

Volume

1,900,000

960,000

480,000

240,000

Mar 12 Jun 12 Sep 12 Dec 12 Mar 13

Financial Engines increased 48% from November 2012–March 2013.