Page 1218 - How to Make Money in Stocks Trilogy

P. 1218

Don’t Invest Blindly: Use Charts to See the Best Time to Buy and Sell 201

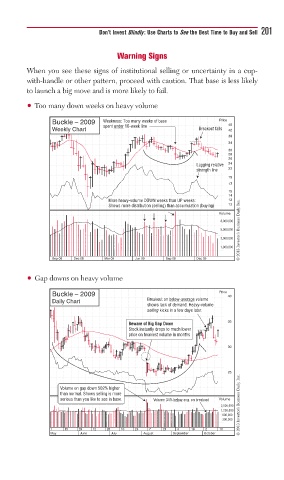

Warning Signs

When you see these signs of institutional selling or uncertainty in a cup-

with-handle or other pattern, proceed with caution. That base is less likely

to launch a big move and is more likely to fail.

• Too many down weeks on heavy volume

Buckle – 2009 Weakness: Too many weeks of base Price

spent under 10-week line 46

Weekly Chart Breakout fails 42

38

34

30

28

26

Lagging relative 24

strength line 22

19

17

15

14

More heavy-volume DOWN weeks than UP weeks: 13

Shows more distribution (selling) than accumulation (buying) 12

Volume

8,000,000

5,000,000 © 2013 Investor’s Business Daily, Inc.

3,000,000

1,800,000

Sep 08 Dec 08 Mar 09 Jun 09 Sep 09 Dec 09

• Gap downs on heavy volume

Buckle – 2009 Price 40

Daily Chart Breakout on below-average volume

shows lack of demand. Heavy-volume

selling kicks in a few days later.

35

Beware of Big Gap Down

Stock instantly drops to much lower

price on heaviest volume in months

30

25

Volume on gap down 502% higher

than normal. Shows selling is more

serious than you like to see in base. Volume 34% below avg. on breakout Volume

2,500,000 © 2013 Investor’s Business Daily, Inc.

1,200,000

600,000

300,000

1 15 29 12 26 10 24 7 21 4 18 2 16

May June July August September October