Page 1241 - How to Make Money in Stocks Trilogy

P. 1241

Don’t Invest Blindly: Use Charts to See the Best Time to Buy and Sell 223

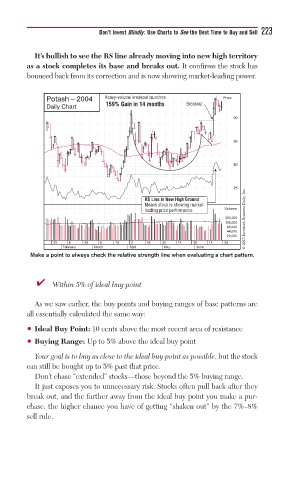

It’s bullish to see the RS line already moving into new high territory

as a stock completes its base and breaks out. It confirms the stock has

bounced back from its correction and is now showing market-leading power.

Potash – 2004 Heavy-volume breakout launches Price

Daily Chart 159% Gain in 14 months Breakout

90

85

80

75

RS Line in New High Ground

Means stock is showing market-

leading price performance Volume

350,000 © 2013 Investor’s Business Daily, Inc.

168,000

86,000

44,000

22,000

23 6 20 5 19 2 16 30 14 28 11 25

February March April May June

Make a point to always check the relative strength line when evaluating a chart pattern.

■ ✔ Within 5% of ideal buy point

As we saw earlier, the buy points and buying ranges of base patterns are

all essentially calculated the same way:

• Ideal Buy Point: 10 cents above the most recent area of resistance

• Buying Range: Up to 5% above the ideal buy point

Your goal is to buy as close to the ideal buy point as possible, but the stock

can still be bought up to 5% past that price.

Don’t chase “extended” stocks—those beyond the 5% buying range.

It just exposes you to unnecessary risk. Stocks often pull back after they

break out, and the farther away from the ideal buy point you make a pur-

chase, the higher chance you have of getting “shaken out” by the 7%–8%

sell rule.