Page 1240 - How to Make Money in Stocks Trilogy

P. 1240

222 HOW TO MAKE MONEY IN STOCKS—GETTING STARTED

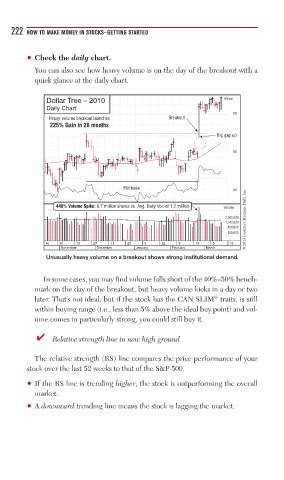

• Check the daily chart.

You can also see how heavy volume is on the day of the breakout with a

quick glance at the daily chart.

Dollar Tree – 2010 Price

Daily Chart

55

Heavy-volume breakout launches Breakout

225% Gain in 28 months

Big gap up

50

Flat base

© 2013 Investor’s Business Daily, Inc.

45

448% Volume Spike: 6.7 million shares vs. Avg. Daily Vol. of 1.2 million Volume

2,000,000

1,100,000

600,000

300,000

16 30 13 27 11 25 8 22 5 19 5 19

November December January February March

Unusually heavy volume on a breakout shows strong institutional demand.

In some cases, you may find volume falls short of the 40%–50% bench-

mark on the day of the breakout, but heavy volume kicks in a day or two

®

later. That’s not ideal, but if the stock has the CAN SLIM traits, is still

within buying range (i.e., less than 5% above the ideal buy point) and vol-

ume comes in particularly strong, you could still buy it.

■ ✔ Relative strength line in new high ground

The relative strength (RS) line compares the price performance of your

stock over the last 52 weeks to that of the S&P 500.

• If the RS line is trending higher, the stock is outperforming the overall

market.

• A downward trending line means the stock is lagging the market.