Page 261 - How to Make Money in Stocks Trilogy

P. 261

142 A WINNING SYSTEM

the stock at last tightened up its price structure from points I to J to K, and

15 weeks later, at point K, it broke out of a tight, sound base and nearly

tripled in price afterwards. Note the stock’s strong uptrend and materially

improved relative strength line for 11 months from point K back to point F.

So, there really is a right time and a wrong time to buy a stock, but under-

standing the difference requires some study. There’s no such thing as being

an overnight success in the stock market, and success has nothing to do with

listening to tips from other people or being lucky. You have to study and pre-

pare yourself so that you can become successful on your own with your

investing. So make yourself more knowledgeable. It isn’t easy at first, but it

can be very rewarding. Anyone can learn to do it. You can do it. Believe in

your ability to learn. Unlearn past assumptions that didn’t work.

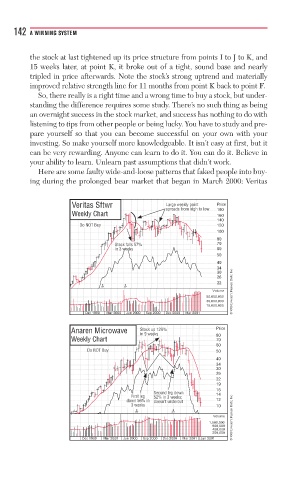

Here are some faulty wide-and-loose patterns that faked people into buy-

ing during the prolonged bear market that began in March 2000: Veritas

Veritas Sftwr Large weekly pointpoinweer Price

spreads from high to low

spreads from high to lowhighds frr w w 190

Weekly Chart 160

140

Do NOT BuyNOT BuyOT Buo

Do 120

100

80

Stock falls 57%falls 57%7k fallst % % 70

Stock

i

eeksekss

we

wee

in 3 wn3wwn wee 60

50

40

34

30

26

22

3/2 3/2

Volume © 2009 Investor’s Business Daily, Inc.

50,000,000

30,000,000

18,000,000

Dec 1999 Mar 2000 Jun 2000 Sep 2000 Dec 2000 Mar 2001

S

Anaren Microwave Stock % % Price

Stock up 129%up 129%9ck up

in 9 weeksween

80

Weekly Chart 70

60

D

Do NOT Buy y y y 50

Do NOT BuyBuyNOT

40

34

30

26

22

19

16

Second leg downg dowond

First leglegei First 52% in 3 weeks;weeks% in 3 14

down 56% in56% in6% i

dow

down d doesn’t undercut’tsn’t d dercu t 12

3 weeksk

3 weeks 10

3/2 2/1

Volume © 2009 Investor’s Business Daily, Inc.

1,600,000

800,000

400,000

200,000

Dec 1999 Mar 2000 Jun 2000 Sep 2000 Dec 2000 Mar 2001 Jun 2001