Page 444 - How to Make Money in Stocks Trilogy

P. 444

314 INVESTING LIKE A PROFESSIONAL

© 2009 Investor’s Business Daily, Inc.

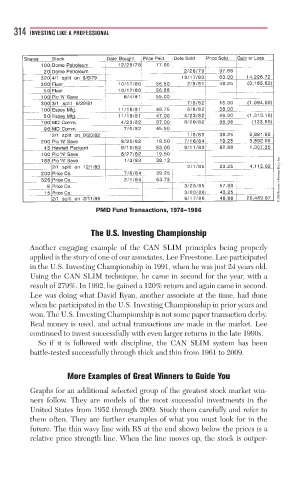

PMD Fund Transactions, 1978–1986

The U.S. Investing Championship

Another engaging example of the CAN SLIM principles being properly

applied is the story of one of our associates, Lee Freestone. Lee participated

in the U.S. Investing Championship in 1991, when he was just 24 years old.

Using the CAN SLIM technique, he came in second for the year, with a

result of 279%. In 1992, he gained a 120% return and again came in second.

Lee was doing what David Ryan, another associate at the time, had done

when he participated in the U.S. Investing Championship in prior years and

won. The U.S. Investing Championship is not some paper transaction derby.

Real money is used, and actual transactions are made in the market. Lee

continued to invest successfully with even larger returns in the late 1990s.

So if it is followed with discipline, the CAN SLIM system has been

battle-tested successfully through thick and thin from 1961 to 2009.

More Examples of Great Winners to Guide You

Graphs for an additional selected group of the greatest stock market win-

ners follow. They are models of the most successful investments in the

United States from 1952 through 2009. Study them carefully and refer to

them often. They are further examples of what you must look for in the

future. The thin wavy line with RS at the end shown below the prices is a

relative price strength line. When the line moves up, the stock is outper-