Page 143 - Account 10

P. 143

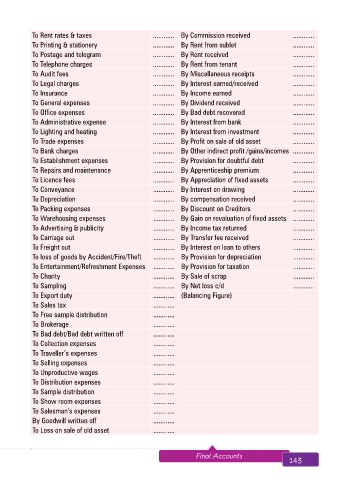

To Rent rates & taxes ............ By Commission received ............

To Printing & stationery ............ By Rent from sublet ............

To Postage and telegram ............ By Rent received ............

To Telephone charges ............ By Rent from tenant ............

To Audit fees ............ By Miscellaneous receipts ............

To Legal charges ............ By Interest earned/received ............

To Insurance ............ By Income earned ............

To General expenses ............ By Dividend received ............

To Office expenses ............ By Bad debt recovered ............

To Administrative expense ............ By Interest from bank ............

To Lighting and heating ............ By Interest from investment ............

To Trade expenses ............ By Profit on sale of old asset ............

To Bank charges ............ By Other indirect profit /gains/incomes ............

To Establishment expenses ............ By Provision for doubtful debt ............

To Repairs and maintenance ............ By Apprenticeship premium ............

To Licence fees ............ By Appreciation of fixed assets ............

To Conveyance ............ By Interest on drawing ............

To Depreciation ............ By compensation received ............

To Packing expenses ............ By Discount on Creditors ............

To Warehousing expenses ............ By Gain on revaluation of fixed assets ............

To Advertising & publicity ............ By Income tax returned ............

To Carriage out ............ By Transfer fee received ............

To Freight out ............ By Interest on loan to others ............

To loss of goods by Accident/Fire/Theft ............ By Provision for depreciation ............

To Entertainment/Refreshment Expenses ............ By Provision for taxation ............

To Charity ............ By Sale of scrap ............

To Sampling ............ By Net loss c/d ............

To Export duty ............ (Balancing Figure)

To Sales tax ............

To Free sample distribution ............

To Brokerage ............

To Bad debt/Bad debt written off ............

To Collection expenses ............

To Traveller’s expenses ............

To Selling expenses ............

To Unproductive wages ............

To Distribution expenses ............

To Sample distribution ............

To Show room expenses ............

To Salesman’s expenses ............

By Goodwill written off ............

To Loss on sale of old asset ............

142 Aakar’s Office Practice and Accountancy - 10 Final Accounts 143