Page 144 - Account 10

P. 144

By Amortization of goodwill ............

To Discount ............

To Preliminary expenses written off ............

To Commission ............

To Interest on loan/interest allowed ............

To Interest on bank overdraft ............

To Interest on capital ............

To Net profit c/d ............

(Balancing Figure)

Total ............ Total ............

Procedures of Preparing Profit and Loss Account

Following are the procedures of preparing profit and loss account.

1. It is prepared in the form of ledger account and thus, it contains two sides i.e. debit

and credit.

2. The gross profit should be entered in credit side and the gross loss in debit side.

3. The word ‘To’ and ‘By’ should be used in debit and credit side respectively.

4. All the indirect expenses, losses and nominal account are entered in debit side and

the indirect incomes and gains are entered in credit side of profit and loss A/c.

5. The net profit and net loss of the business firm should be determined by comparing

the total of debit side and the total of credit side.

6. The balancing figure appearing in debit side is termed as net profit under the word

“To net profit c/d” and the balancing figure appearing in credit side is termed as net

loss under the word, “By net loss c/d”.

7. After determination of net profit or net loss, it should be closed by drawing two

parallel lines.

Note: Nowadays for convenience, Trading and Profit and Loss Account are combined

together and it is known as ‘Trading and profit and Loss Account’. First part is

prepared to ascertain the gross profit or gross loss and the second part is prepared

for net profit or net loss.

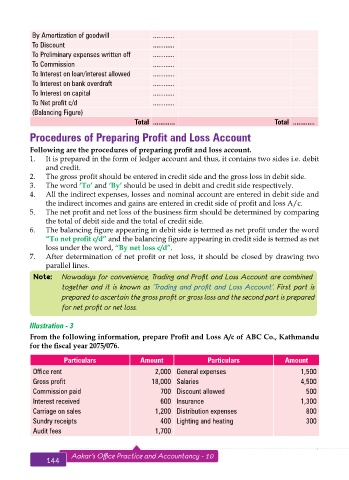

Illustration - 3

From the following information, prepare Profit and Loss A/c of ABC Co., Kathmandu

for the fiscal year 2075/076.

Particulars Amount Particulars Amount

Office rent 2,000 General expenses 1,500

Gross profit 18,000 Salaries 4,500

Commission paid 700 Discount allowed 500

Interest received 600 Insurance 1,300

Carriage on sales 1,200 Distribution expenses 800

Sundry receipts 400 Lighting and heating 300

Audit fees 1,700

144 Aakar’s Office Practice and Accountancy - 10 Final Accounts 145