Page 235 - Office Practice and Accounting 10

P. 235

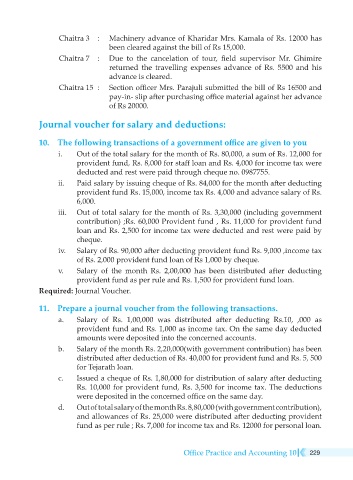

Chaitra 3 : Machinery advance of Kharidar Mrs. Kamala of Rs. 12000 has

been cleared against the bill of Rs 15,000.

Chaitra 7 : Due to the cancelation of tour, field supervisor Mr. Ghimire

returned the travelling expenses advance of Rs. 5500 and his

advance is cleared.

Chaitra 15 : Section officer Mrs. Parajuli submitted the bill of Rs 16500 and

pay-in- slip after purchasing office material against her advance

of Rs 20000.

Journal voucher for salary and deductions:

10. The following transactions of a government office are given to you

i. Out of the total salary for the month of Rs. 80,000, a sum of Rs. 12,000 for

provident fund, Rs. 8,000 for staff loan and Rs. 4,000 for income tax were

deducted and rest were paid through cheque no. 0987755.

ii. Paid salary by issuing cheque of Rs. 84,000 for the month after deducting

provident fund Rs. 15,000, income tax Rs. 4,000 and advance salary of Rs.

6,000.

iii. Out of total salary for the month of Rs. 3,30,000 (including government

contribution) ;Rs. 60,000 Provident fund , Rs. 11,000 for provident fund

loan and Rs. 2,500 for income tax were deducted and rest were paid by

cheque.

iv. Salary of Rs. 90,000 after deducting provident fund Rs. 9,000 ,income tax

of Rs. 2,000 provident fund loan of Rs 1,000 by cheque.

v. Salary of the month Rs. 2,00,000 has been distributed after deducting

provident fund as per rule and Rs. 1,500 for provident fund loan.

Required: Journal Voucher.

11. Prepare a journal voucher from the following transactions.

a. Salary of Rs. 1,00,000 was distributed after deducting Rs.10, ,000 as

provident fund and Rs. 1,000 as income tax. On the same day deducted

amounts were deposited into the concerned accounts.

b. Salary of the month Rs. 2,20,000(with government contribution) has been

distributed after deduction of Rs. 40,000 for provident fund and Rs. 5, 500

for Tejarath loan.

c. Issued a cheque of Rs. 1,80,000 for distribution of salary after deducting

Rs. 10,000 for provident fund, Rs. 3,500 for income tax. The deductions

were deposited in the concerned office on the same day.

d. Out of total salary of the month Rs. 8,80,000 (with government contribution),

and allowances of Rs. 25,000 were distributed after deducting provident

fund as per rule ; Rs. 7,000 for income tax and Rs. 12000 for personal loan.

Office Practice and Accounting 10 229