Page 239 - Office Practice and Accounting 10

P. 239

Magh 28 : Paid salary by issuing cheque of Rs. 84,000 for the month of Magh after

deducting provident fund Rs. 15,000, Income tax Rs. 3,000 and advance

salary of Rs. 2,000.

Required : Journal Vouchers.

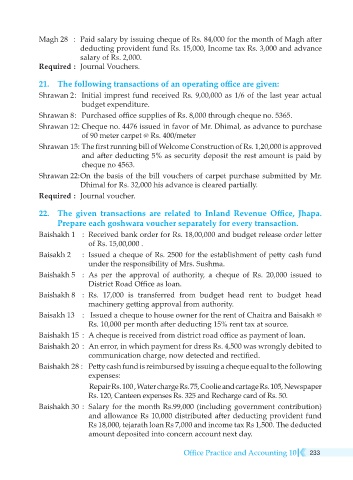

21. The following transactions of an operating office are given:

Shrawan 2 : Initial imprest fund received Rs. 9,00,000 as 1/6 of the last year actual

budget expenditure.

Shrawan 8 : Purchased office supplies of Rs. 8,000 through cheque no. 5365.

Shrawan 12: Cheque no. 4476 issued in favor of Mr. Dhimal, as advance to purchase

of 90 meter carpet @ Rs. 400/meter

Shrawan 15: The first running bill of Welcome Construction of Rs. 1,20,000 is approved

and after deducting 5% as security deposit the rest amount is paid by

cheque no 4563.

Shrawan 22: On the basis of the bill vouchers of carpet purchase submitted by Mr.

Dhimal for Rs. 32,000 his advance is cleared partially.

Required : Journal voucher.

22. The given transactions are related to Inland Revenue Office, Jhapa.

Prepare each goshwara voucher separately for every transaction.

Baishakh 1 : Received bank order for Rs. 18,00,000 and budget release order letter

of Rs. 15,00,000 .

Baisakh 2 : Issued a cheque of Rs. 2500 for the establishment of petty cash fund

under the responsibility of Mrs. Sushma.

Baishakh 5 : As per the approval of authority, a cheque of Rs. 20,000 issued to

District Road Office as loan.

Baishakh 8 : Rs. 17,000 is transferred from budget head rent to budget head

machinery getting approval from authority.

Baisakh 13 : Issued a cheque to house owner for the rent of Chaitra and Baisakh @

Rs. 10,000 per month after deducting 15% rent tax at source.

Baishakh 15 : A cheque is received from district road office as payment of loan.

Baishakh 20 : An error, in which payment for dress Rs. 4,500 was wrongly debited to

communication charge, now detected and rectified.

Baishakh 28 : Petty cash fund is reimbursed by issuing a cheque equal to the following

expenses:

Repair Rs. 100 , Water charge Rs. 75, Coolie and cartage Rs. 105, Newspaper

Rs. 120, Canteen expenses Rs. 325 and Recharge card of Rs. 50.

Baishakh 30 : Salary for the month Rs.99,000 (including government contribution)

and allowance Rs 10,000 distributed after deducting provident fund

Rs 18,000, tejarath loan Rs 7,000 and income tax Rs 1,500. The deducted

amount deposited into concern account next day.

Office Practice and Accounting 10 233