Page 237 - Office Practice and Accounting 10

P. 237

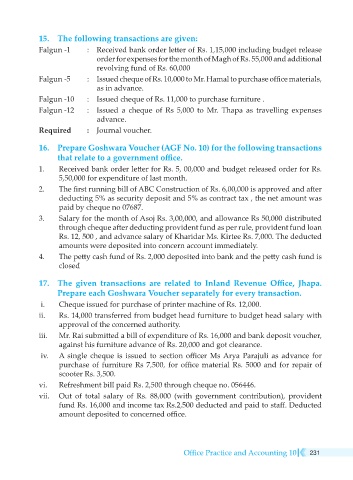

15. The following transactions are given:

Falgun -1 : Received bank order letter of Rs. 1,15,000 including budget release

order for expenses for the month of Magh of Rs. 55,000 and additional

revolving fund of Rs. 60,000

Falgun -5 : Issued cheque of Rs. 10,000 to Mr. Hamal to purchase office materials,

as in advance.

Falgun -10 : Issued cheque of Rs. 11,000 to purchase furniture .

Falgun -12 : Issued a cheque of Rs 5,000 to Mr. Thapa as travelling expenses

advance.

Required : Journal voucher.

16. Prepare Goshwara Voucher (AGF No. 10) for the following transactions

that relate to a government office.

1. Received bank order letter for Rs. 5, 00,000 and budget released order for Rs.

5,50,000 for expenditure of last month.

2. The first running bill of ABC Construction of Rs. 6,00,000 is approved and after

deducting 5% as security deposit and 5% as contract tax , the net amount was

paid by cheque no 07687.

3. Salary for the month of Asoj Rs. 3,00,000, and allowance Rs 50,000 distributed

through cheque after deducting provident fund as per rule, provident fund loan

Rs. 12, 500 , and advance salary of Kharidar Ms. Kirtee Rs. 7,000. The deducted

amounts were deposited into concern account immediately.

4. The petty cash fund of Rs. 2,000 deposited into bank and the petty cash fund is

closed

17. The given transactions are related to Inland Revenue Office, Jhapa.

Prepare each Goshwara Voucher separately for every transaction.

i. Cheque issued for purchase of printer machine of Rs. 12,000.

ii. Rs. 14,000 transferred from budget head furniture to budget head salary with

approval of the concerned authority.

iii. Mr. Rai submitted a bill of expenditure of Rs. 16,000 and bank deposit voucher,

against his furniture advance of Rs. 20,000 and got clearance.

iv. A single cheque is issued to section officer Ms Arya Parajuli as advance for

purchase of furniture Rs 7,500, for office material Rs. 5000 and for repair of

scooter Rs. 3,500.

vi. Refreshment bill paid Rs. 2,500 through cheque no. 056446.

vii. Out of total salary of Rs. 88,000 (with government contribution), provident

fund Rs. 16,000 and income tax Rs.2,500 deducted and paid to staff. Deducted

amount deposited to concerned office.

Office Practice and Accounting 10 231