Page 281 - Office Practice and Accounting 10

P. 281

15 Shrawan, Paid for fuel 5,000 5,000

2071

19 Shrawan, Rent paid 10000 10000

2071

22 Shrawan, Dress 12000 12000

2071 Purchased

28 Shrawan Salary 70,000 70,000

2071 distribution

after

provident

fund

deduction

Total for the month of Shrawan 108000 70000 12000 10000 5000 1000 10000

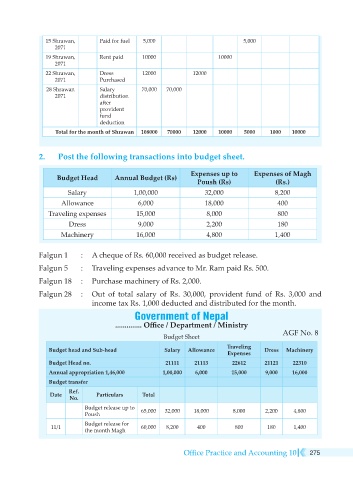

2. Post the following transactions into budget sheet.

Expenses up to Expenses of Magh

Budget Head Annual Budget (Rs)

Poush (Rs) (Rs.)

Salary 1,00,000 32,000 8,200

Allowance 6,000 18,000 400

Traveling expenses 15,000 8,000 800

Dress 9,000 2,200 180

Machinery 16,000 4,800 1,400

Falgun 1 : A cheque of Rs. 60,000 received as budget release.

Falgun 5 : Traveling expenses advance to Mr. Ram paid Rs. 500.

Falgun 18 : Purchase machinery of Rs. 2,000.

Falgun 28 : Out of total salary of Rs. 30,000, provident fund of Rs. 3,000 and

income tax Rs. 1,000 deducted and distributed for the month.

Government of Nepal

.............. Office / Department / Ministry

Budget Sheet AGF No. 8

Traveling

Budget head and Sub-head Salary Allowance Dress Machinery

Expenses

Budget Head no. 21111 21113 22612 21121 22310

Annual appropriation 1,46,000 1,00,000 6,000 15,000 9,000 16,000

Budget transfer

Ref.

Date Particulars Total

No.

Budget release up to 65,000 32,000 18,000 8,000 2,200 4,800

Poush

Budget release for

11/1 60,000 8,200 400 800 180 1,400

the month Magh

Office Practice and Accounting 10 275