Page 286 - Office Practice and Accounting 10

P. 286

Practical Problems

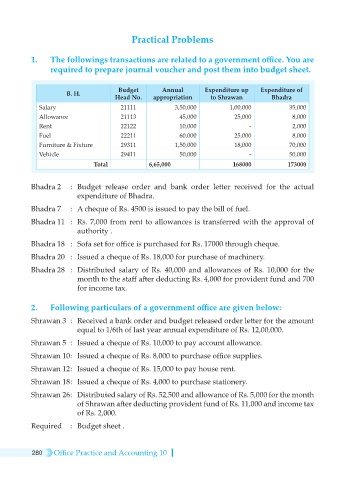

1. The followings transactions are related to a government office. You are

required to prepare journal voucher and post them into budget sheet.

B. H. Budget Annual Expenditure up Expenditure of

Head No. appropriation to Shrawan Bhadra

Salary 21111 3,50,000 1,00,000 35,000

Allowance 21113 45,000 25,000 8,000

Rent 22122 10,000 - 2,000

Fuel 22211 60,000 25,000 8,000

Furniture & Fixture 29311 1,50,000 18,000 70,000

Vehicle 29411 50,000 - 50,000

Total 6,65,000 168000 173000

Bhadra 2 : Budget release order and bank order letter received for the actual

expenditure of Bhadra.

Bhadra 7 : A cheque of Rs. 4500 is issued to pay the bill of fuel.

Bhadra 11 : Rs. 7,000 from rent to allowances is transferred with the approval of

authority .

Bhadra 18 : Sofa set for office is purchased for Rs. 17000 through cheque.

Bhadra 20 : Issued a cheque of Rs. 18,000 for purchase of machinery.

Bhadra 28 : Distributed salary of Rs. 40,000 and allowances of Rs. 10,000 for the

month to the staff after deducting Rs. 4,000 for provident fund and 700

for income tax.

2. Following particulars of a government office are given below:

Shrawan 3 : Received a bank order and budget released order letter for the amount

equal to 1/6th of last year annual expenditure of Rs. 12,00,000.

Shrawan 5 : Issued a cheque of Rs. 10,000 to pay account allowance.

Shrawan 10 : Issued a cheque of Rs. 8,000 to purchase office supplies.

Shrawan 12 : Issued a cheque of Rs. 15,000 to pay house rent.

Shrawan 18 : Issued a cheque of Rs. 4,000 to purchase stationery.

Shrawan 26 : Distributed salary of Rs. 52,500 and allowance of Rs. 5,000 for the month

of Shrawan after deducting provident fund of Rs. 11,000 and income tax

of Rs. 2,000.

Required : Budget sheet .

280 Office Practice and Accounting 10