Page 301 - Office Practice and Accounting 10

P. 301

Bank Balance = Total revolving fund – Total expenditure up to Katiik –Petty cash fund

= Rs. 2,00,000 – 1,90,000 – 1,000 = 9,000.

Note: Deposit is recorded in deposit account separately.

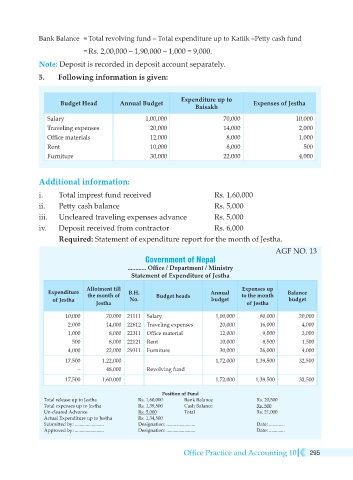

5. Following information is given:

Budget Head Annual Budget Expenditure up to Expenses of Jestha

Baisakh

Salary 1,00,000 70,000 10,000

Traveling expenses 20,000 14,000 2,000

Office materials 12,000 8,000 1,000

Rent 10,000 8,000 500

Furniture 30,000 22,000 4,000

Additional information:

i. Total imprest fund received Rs. 1,60,000

ii. Petty cash balance Rs. 5,000

iii. Uncleared traveling expenses advance Rs. 5,000

iv. Deposit received from contractor Rs. 6,000

Required: Statement of expenditure report for the month of Jestha.

AGF NO. 13

Government of Nepal

............ Office / Department / Ministry

Statement of Expenditure of Jestha

Allotment till Expenses up

Expenditure the month of B.H. Budget heads Annual to the month Balance

of Jestha No. budget budget

Jestha of Jestha

10,000 70,000 21111 Salary 1,00,000 80,000 20,000

2,000 14,000 22612 Traveling expenses 20,000 16,000 4,000

1,000 8,000 22311 Office material 12,000 9,000 3,000

500 8,000 22121 Rent 10,000 8,500 1,500

4,000 22,000 29311 Furniture 30,000 26,000 4,000

17,500 1,22,000 1,72,000 1,39,500 32,500

– 48,000 Revolving fund

17,500 1,60,000 1,72,000 1,39,500 32,500

Position of Fund

Total release up to Jestha Rs. 1,60,000 Bank Balance Rs. 20,500

Total expenses up to Jestha Rs. 1,39,500 Cash Balance Rs. 500

Un-cleared Advance Rs. 5,000 Total Rs. 21,000

Actual Expenditure up to Jestha Rs. 1,34,500

Submitted by: ........................ Designation: ........................ Date: .............

Approved by: ........................ Designation: ........................ Date: .............

Office Practice and Accounting 10 295