Page 133 - Office Practice and Accounting -9

P. 133

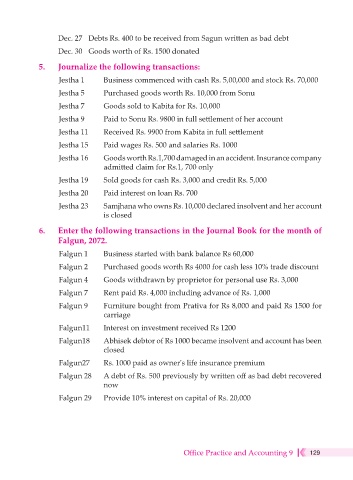

Dec. 27 Debts Rs. 400 to be received from Sagun written as bad debt

Dec. 30 Goods worth of Rs. 1500 donated

5. Journalize the following transactions:

Jestha 1 Business commenced with cash Rs. 5,00,000 and stock Rs. 70,000

Jestha 5 Purchased goods worth Rs. 10,000 from Sonu

Jestha 7 Goods sold to Kabita for Rs. 10,000

Jestha 9 Paid to Sonu Rs. 9800 in full settlement of her account

Jestha 11 Received Rs. 9900 from Kabita in full settlement

Jestha 15 Paid wages Rs. 500 and salaries Rs. 1000

Jestha 16 Goods worth Rs.1,700 damaged in an accident. Insurance company

admitted claim for Rs.1, 700 only

Jestha 19 Sold goods for cash Rs. 3,000 and credit Rs. 5,000

Jestha 20 Paid interest on loan Rs. 700

Jestha 23 Samjhana who owns Rs. 10,000 declared insolvent and her account

is closed

6. Enter the following transactions in the Journal Book for the month of

Falgun, 2072.

Falgun 1 Business started with bank balance Rs 60,000

Falgun 2 Purchased goods worth Rs 4000 for cash less 10% trade discount

Falgun 4 Goods withdrawn by proprietor for personal use Rs. 3,000

Falgun 7 Rent paid Rs. 4,000 including advance of Rs. 1,000

Falgun 9 Furniture bought from Prativa for Rs 8,000 and paid Rs 1500 for

carriage

Falgun11 Interest on investment received Rs 1200

Falgun18 Abhisek debtor of Rs 1000 became insolvent and account has been

closed

Falgun27 Rs. 1000 paid as owner's life insurance premium

Falgun 28 A debt of Rs. 500 previously by written off as bad debt recovered

now

Falgun 29 Provide 10% interest on capital of Rs. 20,000

Office Practice and Accounting 9 129