Page 131 - Office Practice and Accounting -9

P. 131

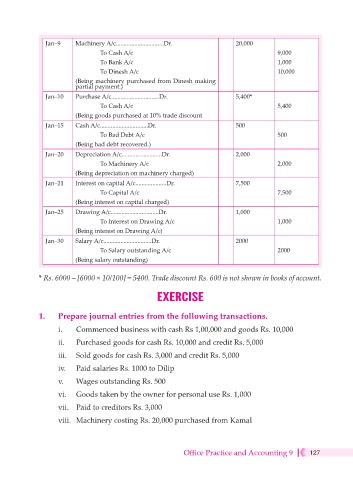

Jan–9 Machinery A/c...............................Dr. 20,000

To Cash A/c 9,000

To Bank A/c 1,000

To Dinesh A/c 10,000

(Being machinery purchased from Dinesh making

partial payment.)

Jan–10 Purchase A/c...............................Dr. 5,400*

To Cash A/c 5,400

(Being goods purchased at 10% trade discount

Jan–15 Cash A/c...............................Dr. 500

To Bad Debt A/c 500

(Being bad debt recovered.)

Jan–20 Depreciation A/c..........................Dr. 2,000

To Machinery A/c 2,000

(Being depreciation on machinery charged)

Jan–21 Interest on capital A/c....................Dr. 7,500

To Capital A/c 7,500

(Being interest on capital charged)

Jan–25 Drawing A/c...............................Dr. 1,000

To Interest on Drawing A/c 1,000

(Being interest on Drawing A/c)

Jan–30 Salary A/c...............................Dr. 2000

To Salary outstanding A/c 2000

(Being salary outstanding)

* Rs. 6000 – [6000 × 10/100] = 5400. Trade discount Rs. 600 is not shown in books of account.

EXERCISE

1. Prepare journal entries from the following transactions.

i. Commenced business with cash Rs 1,00,000 and goods Rs. 10,000

ii. Purchased goods for cash Rs. 10,000 and credit Rs. 5,000

iii. Sold goods for cash Rs. 3,000 and credit Rs. 5,000

iv. Paid salaries Rs. 1000 to Dilip

v. Wages outstanding Rs. 500

vi. Goods taken by the owner for personal use Rs. 1,000

vii. Paid to creditors Rs. 3,000

viii. Machinery costing Rs. 20,000 purchased from Kamal

Office Practice and Accounting 9 127