Page 132 - Office Practice and Accounting -9

P. 132

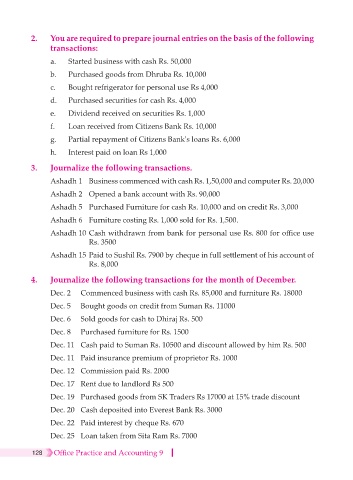

2. You are required to prepare journal entries on the basis of the following

transactions:

a. Started business with cash Rs. 50,000

b. Purchased goods from Dhruba Rs. 10,000

c. Bought refrigerator for personal use Rs 4,000

d. Purchased securities for cash Rs. 4,000

e. Dividend received on securities Rs. 1,000

f. Loan received from Citizens Bank Rs. 10,000

g. Partial repayment of Citizens Bank's loans Rs. 6,000

h. Interest paid on loan Rs 1,000

3. Journalize the following transactions.

Ashadh 1 Business commenced with cash Rs. 1,50,000 and computer Rs. 20,000

Ashadh 2 Opened a bank account with Rs. 90,000

Ashadh 5 Purchased Furniture for cash Rs. 10,000 and on credit Rs. 3,000

Ashadh 6 Furniture costing Rs. 1,000 sold for Rs. 1,500.

Ashadh 10 Cash withdrawn from bank for personal use Rs. 800 for office use

Rs. 3500

Ashadh 15 Paid to Sushil Rs. 7900 by cheque in full settlement of his account of

Rs. 8,000

4. Journalize the following transactions for the month of December.

Dec. 2 Commenced business with cash Rs. 85,000 and furniture Rs. 18000

Dec. 5 Bought goods on credit from Suman Rs. 11000

Dec. 6 Sold goods for cash to Dhiraj Rs. 500

Dec. 8 Purchased furniture for Rs. 1500

Dec. 11 Cash paid to Suman Rs. 10500 and discount allowed by him Rs. 500

Dec. 11 Paid insurance premium of proprietor Rs. 1000

Dec. 12 Commission paid Rs. 2000

Dec. 17 Rent due to landlord Rs 500

Dec. 19 Purchased goods from SK Traders Rs 17000 at 15% trade discount

Dec. 20 Cash deposited into Everest Bank Rs. 3000

Dec. 22 Paid interest by cheque Rs. 670

Dec. 25 Loan taken from Sita Ram Rs. 7000

128 Office Practice and Accounting 9