Page 130 - Office Practice and Accounting -9

P. 130

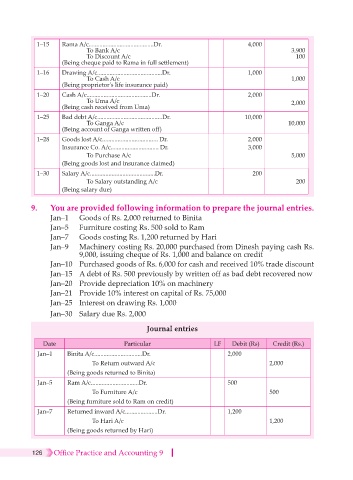

1–15 Rama A/c..........................................Dr. 4,000

To Bank A/c 3,900

To Discount A/c 100

(Being cheque paid to Rama in full settlement)

1–16 Drawing A/c..........................................Dr. 1,000

To Cash A/c 1,000

(Being proprietor's life insurance paid)

1–20 Cash A/c..........................................Dr. 2,000

To Uma A/c 2,000

(Being cash received from Uma)

1–25 Bad debt A/c..........................................Dr. 10,000

To Ganga A/c 10,000

(Being account of Ganga written off)

1–28 Goods lost A/c.................................... Dr. 2,000

Insurance Co. A/c............................... Dr. 3,000

To Purchase A/c 5,000

(Being goods lost and insurance claimed)

1–30 Salary A/c..........................................Dr. 200

To Salary outstanding A/c 200

(Being salary due)

9. You are provided following information to prepare the journal entries.

Jan–1 Goods of Rs. 2,000 returned to Binita

Jan–5 Furniture costing Rs. 500 sold to Ram

Jan–7 Goods costing Rs. 1,200 returned by Hari

Jan–9 Machinery costing Rs. 20,000 purchased from Dinesh paying cash Rs.

9,000, issuing cheque of Rs. 1,000 and balance on credit

Jan–10 Purchased goods of Rs. 6,000 for cash and received 10% trade discount

Jan–15 A debt of Rs. 500 previously by written off as bad debt recovered now

Jan–20 Provide depreciation 10% on machinery

Jan–21 Provide 10% interest on capital of Rs. 75,000

Jan–25 Interest on drawing Rs. 1,000

Jan–30 Salary due Rs. 2,000

Journal entries

Date Particular LF Debit (Rs) Credit (Rs.)

Jan–1 Binita A/c...............................Dr. 2,000

To Return outward A/c 2,000

(Being goods returned to Binita)

Jan–5 Ram A/c...............................Dr. 500

To Furniture A/c 500

(Being furniture sold to Ram on credit)

Jan–7 Returned inward A/c.....................Dr. 1,200

To Hari A/c 1,200

(Being goods returned by Hari)

126 Office Practice and Accounting 9