Page 128 - Office Practice and Accounting -9

P. 128

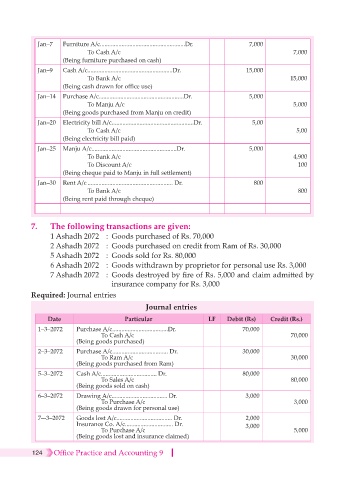

Jan–7 Furniture A/c.......................................................Dr. 7,000

To Cash A/c 7,000

(Being furniture purchased on cash)

Jan–9 Cash A/c.......................................................Dr. 15,000

To Bank A/c 15,000

(Being cash drawn for office use)

Jan–14 Purchase A/c.......................................................Dr. 5,000

To Manju A/c 5,000

(Being goods purchased from Manju on credit)

Jan–20 Electricity bill A/c.....................................................Dr. 5,00

To Cash A/c 5,00

(Being electricity bill paid)

Jan–25 Manju A/c.......................................................Dr. 5,000

To Bank A/c 4,900

To Discount A/c 100

(Being cheque paid to Manju in full settlement)

Jan–30 Rent A/c ....................................................... Dr. 800

To Bank A/c 800

(Being rent paid through cheque)

7. The following transactions are given:

1 Ashadh 2072 : Goods purchased of Rs. 70,000

2 Ashadh 2072 : Goods purchased on credit from Ram of Rs. 30,000

5 Ashadh 2072 : Goods sold for Rs. 80,000

6 Ashadh 2072 : Goods withdrawn by proprietor for personal use Rs. 3,000

7 Ashadh 2072 : Goods destroyed by fire of Rs. 5,000 and claim admitted by

insurance company for Rs. 3,000

Required: Journal entries

Journal entries

Date Particular LF Debit (Rs) Credit (Rs.)

1–3–2072 Purchase A/c....................................Dr. 70,000

To Cash A/c 70,000

(Being goods purchased)

2–3–2072 Purchase A/c.................................... Dr. 30,000

To Ram A/c 30,000

(Being goods purchased from Ram)

5–3–2072 Cash A/c.................................... Dr. 80,000

To Sales A/c 80,000

(Being goods sold on cash)

6–3–2072 Drawing A/c.................................... Dr. 3,000

To Purchase A/c 3,000

(Being goods drawn for personal use)

7–-3–2072 Goods lost A/c.................................... Dr. 2,000

Insurance Co. A/c............................... Dr. 3,000

To Purchase A/c 5,000

(Being goods lost and insurance claimed)

124 Office Practice and Accounting 9