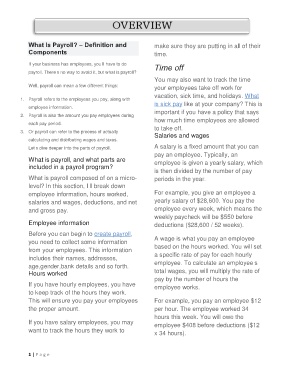

Page 1 - Microsoft Word - Things that you need to know to successfully work in Belina Payroll System

P. 1

What Is Payroll? – Definition and make sure they are putting in all of their

Components time.

If your business has employees, you’ll have to do Time off

payroll. There’s no way to avoid it, but what is payroll?

You may also want to track the time

Well, payroll can mean a few different things: your employees take off work for

vacation, sick time, and holidays. What

1. Payroll refers to the employees you pay, along with

is sick pay like at your company? This is

employee information.

important if you have a policy that says

2. Payroll is also the amount you pay employees during

how much time employees are allowed

each pay period.

to take off.

3. Or payroll can refer to the process of actually

Salaries and wages

calculating and distributing wages and taxes.

Let’s dive deeper into the parts of payroll. A salary is a fixed amount that you can

pay an employee. Typically, an

What is payroll, and what parts are employee is given a yearly salary, which

included in a payroll program?

is then divided by the number of pay

What is payroll composed of on a micro- periods in the year.

level? In this section, I’ll break down

employee information, hours worked, For example, you give an employee a

salaries and wages, deductions, and net yearly salary of $28,600. You pay the

and gross pay. employee every week, which means the

weekly paycheck will be $550 before

Employee information deductions ($28,600 / 52 weeks).

Before you can begin to create payroll,

you need to collect some information A wage is what you pay an employee

from your employees. This information based on the hours worked. You will set

includes their names, addresses, a specific rate of pay for each hourly

age,gender,bank details and so forth. employee. To calculate an employee’s

Hours worked total wages, you will multiply the rate of

pay by the number of hours the

If you have hourly employees, you have employee works.

to keep track of the hours they work.

This will ensure you pay your employees For example, you pay an employee $12

the proper amount. per hour. The employee worked 34

hours this week. You will owe the

If you have salary employees, you may employee $408 before deductions ($12

want to track the hours they work to x 34 hours).

1 | P a g e