Page 8 - Microsoft Word - Things that you need to know to successfully work in Belina Payroll System

P. 8

Earn (PAYE) System transactions under headings useful to ZIMRA. This information can be printed in

the form of a report or exported as a file.

The Pay As You Earn (PAYE) system is a method of paying Income Tax on remuneration.

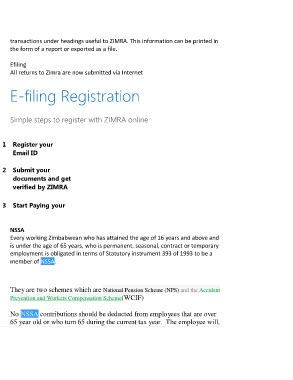

The employer deducts tax from your salaries or pension earnings before paying you the net Efiling

salary or pension. All returns to Zimra are now submitted via Internet

This article is intended to provide you with a simple and logical introduction to some basic

principles of Income Tax as it applies to employees.

The Income Tax Act [Chapter 23:06] specifies what elements of an employee’s E-filing Registration

remuneration or earnings are subject to tax and at what rate of tax. It also deals with what

income is exempt from tax and what deductions are allowed from these earnings, prior to

tax being calculated. Simple steps to register with ZIMRA online

th

The due date for the submission of PAYE returns and payment is the 10 of the following

month.

1 Register your

Email ID

Final Deduction System

2 Submit your

What is the Final Deduction System? documents and get

verified by ZIMRA

This is a system whereby the employer is directed to withhold Employees Tax (P.A.Y.E)

from the employee’s remuneration in such a way as to ensure that the amount so withheld

monthly and in the year of assessment is as nearly the same as the income tax liability that 3 Start Paying your

is expected from the employee concerned. Tax online

Who qualifies to be on FDS?

NSSA

All employers as defined under Paragraph 1 (1) of Part I of the Thirteenth Schedule

to the Income Tax Act (Chapter 23:06) (Income Tax Act). Every working Zimbabwean who has attained the age of 16 years and above and

is under the age of 65 years, who is permanent, seasonal, contract or temporary

ITF 16 employment is obligated in terms of Statutory instrument 393 of 1993 to be a

Historically the ITF16 was a hand written report that was a submitted togethter member of NSSA.

with the P6's as a summary of the P6 information for the year (See FAQ topic 'Tax

- P6's').

CURRENT They are two schemes which are National Pension Scheme (NPS) and the Accident

With the introduction of the FDS tax system (See FAQ Topic 'Tax - FDS') the ITF16 Prevention and Workers Compensation Scheme(WCIF)

has become a central tool in FDS audits to ensure that the correct amount of

PAYE has been deducted in, and during, the year. The ITF16 summarizes payroll No NSSA contributions should be deducted from employees that are over

65 year old or who turn 65 during the current tax year. The employee will,

5 | P a g e