Page 13 - The Pulse Issue 9

P. 13

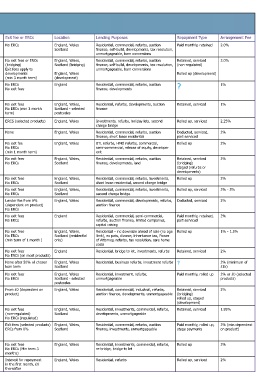

Bridging Finance Matrix

LTV Term Loan Size Loan Type Historic Adverse Exit fee or ERCs Location Lending Purposes Repayment Type Arrangement Fee

Affirmative 75% (100% with No min - 18 months £10k - £5m Regulated No adverse on regulated No ERCs England, Wales Residential, commercial, refurbs, auction Paid monthly, retained 2.0%

additional security) Non-regulated Some adverse on Scotland finance, self-build, developments, tax resolution,

non-regulated unmortgageable, barn conversions

Alternative 75% Residential 3 - 15 months (bridging) £100k - £20m (bridging) Regulated All types of credit considered No exit fees or ERCs England, Wales, Residential, commercial, refurbs, auction Retained, serviced 2.0%

Bridging 70% Development 3 - 24 months £500k - £20m Non-regulated (bridging) Scotland (bridging) finance, self-build, developments, tax resolution, (non-regulated)

(development) (development) Exit fees apply to unmortgageable, barn conversions

developments England, Wales Rolled up (development)

(min 3 month term) (development)

Big Property 75% Residential 1 - 18 months £50k - £5m (residential) Non-regulated All types of credit considered No ERCs England Residential, commercial, refurbs, auction ? 1%

Finance 65% 2nd charge £50k - £2m (commercial) No exit fees finance, developments

residential

70% Commercial

Bridging 70% 1 - 12 months (bridging) £25k - £2.5m Regulated All types of credit considered No exit fees England, Wales, Residential, refurbs, developments, auction Retained, serviced 1%

Finance 1 - 18 months Non-regulated No ERCs (min 3 month Scotland - selected finance

Solutions (development) term) postcodes

Castle Trust 75% 1 - 24 months £15k - £25m Non-regulated All types of credit considered ERCS (selected products) England, Wales Investments, refurbs, holiday lets, second Rolled up, serviced 2.25%

charge bridge

Funding 365 75% (100% with 3 - 12 months £100k - £5m+ Non-regulated All types of credit considered None England, Wales Residential, commercial, refurbs, auction Deducted, serviced, 2%

additional security) finance, short lease residential part-serviced

Interbay 75% 1 - 18 months £100k - £5m (refer to Non-regulated Considered on case by case No exit fee England, Wales BTL refurbs, HMO refurbs, commercial, Rolled up 2%

Commercial Ingard for more) basis No ERCs semi-commercial, release of equity, developer

(min 1 month term) exit

Lendinvest 75% 1 - 24 months £75k - £7.5m (refer to Non-regulated Bankruptcy/ IVA >3 years, all No exit fees England, Wales, Residential, commercial, refurbs, auction Retained, serviced 2%

Ingard for more) CCJs satisfied and <£5k, max No ERCs Scotland finance, developments, land (bridging)

1 mortgage/ secured loan staged (refurbs or

arrear in last 3 years developments)

Masthaven 70% 1 - 18 months £100k - £5m Regulated All types of credit considered No exit fees England, Wales, Residential, commercial, refurbs, investments, Rolled up 2%

Non-regulated No ERCs Scotland short lease residential, second charge bridge

Mercantile Trust 75% Buy to let 1 - 12 months £25k - £1m Non-regulated None in the last 12 months No exit fees England, Wales, Residential, commercial, refurbs, investments, Rolled up, serviced 2% - 3%

60% Commercial No ERCs Scotland second charge bridge

Mint Bridging 75% 1 - 18 months £100k - £5m Non-regulated All types of credit considered, Lender fee from 0% England, Wales Residential, commercial, developments, refurbs, Deducted, serviced 2%

CCJs must be satisfied and (dependent on product) auction finance

<£5k No ERCs

MTF 70% 3 - 24 months £100k - £5m Non-regulated All types of credit considered No exit fees England Residential, commercial, semi-commercial, Paid monthly, retained, 2%

No ERCs refurbs, auction finance, limited companies, part-serviced

capital raising

Oakbridge 65% 1st charge 1-12 months (can be £100K -£5m Regulated Some adverse considered No exit fees England, Wales, Residential - inc downsize ahead of sale (no age Rolled up 1% - 1.5%

50% 2nd charge extended) Non-regulated (refer to Ingard) No ERCs Scotland (residential limit), ex pats, divorce, inheritance tax, Power

in aggregate (min term of 1 month ) only) of Attorney, refurbs, tax resolution, care home

costs

Octopus 65% Regulated 1 - 23 months £50k - ? Regulated All types of credit considered No exit fees England Residential, bridge to let, investments, refurbs Retained, serviced 2%

70% Non-regulated Non-regulated No ERCs (on most products)

Peninsula 70% Residential 1 - 36 months £25k - £750k Regulated All types of credit considered None after 50% of chosen England, Wales Residential, business refurbs, investment refurbs ? 2% (minimum of

Finance 65% Commercial Non-regulated loan term Scotland £1k)

Precise 70% Regulated 1 - 18 months £50k - no max Regulated Some adverse considered No exit fees England, Wales Residential, investment, refurbs, Paid monthly, rolled up 2% or £0 (selected

Mortgages 75% Non-regulated Non-regulated (refer to Ingard) No ERCs Scotland - selected unmortgageable products)

postcodes

Roma Finance 75% (100% with 3 - 12 months £30k - £1m Non-regulated All types of credit considered, From £0 (dependent on England, Wales Residential, commercial, industrial, refurbs, Retained, serviced 2%

additional security) CCJs must be <£5k satisfied product) auction finance, developments, unmortgageable (bridging)

rolled up, staged

(development)

Shawbrook 70% Regulated No min - 24 months £50k - £15m (refer to Regulated Some adverse considered No exit fees England, Wales, Residential, investments, commercial, refurbs, Retained, serviced 1.95%

75% Non-regulated Ingard for more) Non-regulated >24 months (non-regulated) Scotland developments, unmortgageable

No ERCs (regulated)

Together 70% Regulated 3 - 24 months £10k - £2.5m Regulated All types of credit considered Exit fees (selected products) England, Wales, Residential, commercial, refurbs, auction Paid monthly, rolled up, 2% (min dependent

75% Non-regulated Non-regulated ERCs from 0% Scotland finance, investments, unmortgageable stage payments on product)

(100% with additional

security)

True Bridging 80% 3 - 12 months £50k - £15m (refer to Non-regulated All types of credit considered No exit fees England, Wales Residential, investments, commercial, refurbs, Rolled up 2%

Ingard for more) No ERCs (Min term 3 re-bridge, bridge to let

months)

UTB 70% No min - 36 months £75k - £10m+ Regulated All types of credit considered Interest for repayment England, Wales Residential, refurbs Rolled up, serviced 2%

Non-regulated in the first month, £0

thereafter