Page 15 - The Pulse Issue 9

P. 15

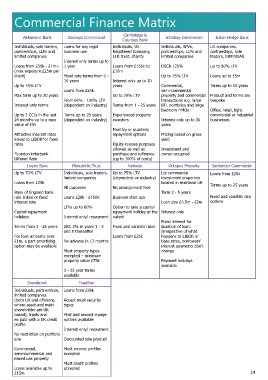

Here’s a Quick Overview of Commercial Finance Matrix

Ingard’s Bridging Finance

Process: Aldermore Bank Barclays Commercial Counties Bank Interbay Commercial Julian Hodge Bank

Cambridge &

Individuals, sole traders, Loans for any legal Individuals, UK Individuals, SPVs, UK companies,

partnerships, LLPs and business use Registered Company, partnerships, LLPs and partnerships, sole

1. limited companies LLP, trust, charity limited companies traders, SIPP/SSAS

Broker contacts Ingard with an overview of the bridging deal by Interest only terms up to

Meet the lender who can telephone, website enquiry or email. Loans from £50k - £1m+ 1 year Loans from £150k to DSCR 125% Up to 80% LTV

£10m

(max exposure £25m per

approve deals that ‘traditional’ The enquiry will be assigned to a dedicated Bridging Specialist client) Fixed rate terms from 1 - Up to 75% LTV Loans up to £5m

who will request you to send all of the information you have

banks and lenders can’t! gathered so far e.g. Fact Find, Credit File etc. This will help us Up to 75% LTV 10 years Interest only up to 10 Commercial, Terms up to 15 years

years

to place the case as quickly as possible.

Loans from £25k semi-commercial

Max term up to 20 years Up to 70% LTV property and commercial Product and terms are

2. From 60% - 100% LTV transactions e.g. large bespoke

True Bridging will ... Ingard will place the case with one of the 21 bridging lenders Interest only terms (dependent on industry) Terms from 1 - 25 years BTL portfolios and large

on our panel and send the introducing broker a DIP which bedroom HMOs Office, retail, light

breaks down the product details, fees and an estimated Up to 2 CCJs in the last Terms up to 25 years Experienced property commercial or industrial

timeline. 24 months up to a max (dependent on industry) investors Interest only up to 30 businesses

lend up to 80% LTV value of £5k Monthly or quarterly years

We will then require you to pass us the client’s contact details Attractive interest rates repayment options Pricing based on gross

to enable us to process the case through to completion,

individually underwrite every deal providing you with regular updates throughout. If you would linked to LIBOR*or fixed yield

like to stay involved and help the client to complete the rates Equity release purposes Investment and

allowed as well as

documents, then we will send you a list of documents we need. *London Interbank purchase and refinance owner-occupied

offer terms from 3 - 12 months Offered Rate (up to 100% of costs)

3. Lloyds Bank Mercantile Trust Natwest Octopus Property Santander Commercial

consider all types of adverse If the client wishes to proceed then Ingard will request a £500 Up to 70% LTV Individuals, sole traders, Up to 75% LTV Let commercial Loans from £25k

Commitment Fee and the Valuation Fee. limited companies (dependent on industry) investment properties

Loans from £25k located in mainland UK

consider all types of property 4. All purposes No arrangement fees Terms up to 25 years

Valuation instructed. Bank of England bank Loans £26k - £150K Business start-ups Term 2 - 5 years Fixed and variable rate

rate linked or fixed

lend in England and Wales interest rate Loan size £0.5m - £2m options

5. Capital repayment LTVs up to 60% Option to take a capital

repayment holiday at the Interest only

not charge exit fees Offer issued (providing the Valuation is satisfactory). holidays Interest only/ repayment outset

Fixed interest for

6. Terms from 3 - 25 years ERC 3% in years 1 - 3 Fixed and variable rates duration of loan:

Solicitor instructed and completion date set. For loan amounts over and 0 thereafter Loans from £25k Irrespective of what

happens to LIBOR or

True Bridging offer ... £1m, a part amortising No adverse in 12 months base rates, borrowers’

7. option may be available interest payments don’t

Ingard will liaise with the Mortgage Broker, Solicitor and client, Most property types change

excepted – minimum

to complete the case as quickly as possible.

bespoke lending property value £75k Payment holidays

available

8. 3 - 25 year terms

same day decisions On completion, the client will be paid the funds from the lender. available

The introducing Mortgage Broker will receive 50% of the Broker Shawbrook Together

Fee and Procuration Fee. Individuals, partnerships, Loans from £26k

a dedicated team of underwriters limited companies Accept most security

(both UK and offshore,

fast access to funds Have a bridging where asset and main types

shareholder are UK

based), trusts and

First and second charge

Products available exclusively through case to discuss? ex pats with a UK credit options available

profile

Ingard Financial. For more information, Interest only/ repayment

call Ingard’s Specialist Team on Contact our Specialist Team: No restriction on portfolio Discounted rate product

size

01702 538 800.

Call us on 01702 538 800; Commercial, Most income profiles

Email an enquiry to info@ingard.co.uk; semi-commercial and accepted

Request a call back - http://distributor.ingard mixed use property Most credit profiles

For intermediaries only. intermediaryservices.co.uk/call-back/ Loans available up to accepted

£15m 14