Page 150 - (DK) The Business Book

P. 150

148 IGNORING THE HERD

14 8

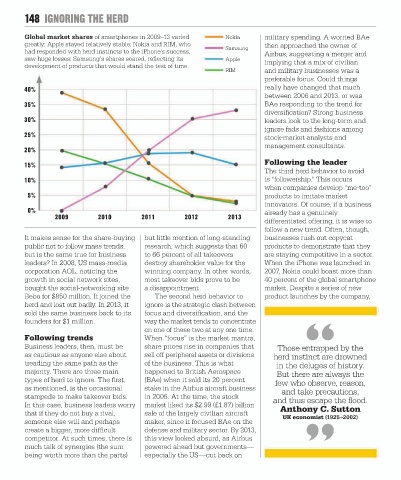

Global market shares of smartphones in 2009–13 varied Nokia military spending. A worried BAe

greatly: Apple stayed relatively stable; Nokia and RIM, who then approached the owner of

Samsung

had responded with herd instincts to the iPhone’s success, Airbus, suggesting a merger and

saw huge losses; Samsung’s shares soared, reflecting its Apple implying that a mix of civilian

development of products that would stand the test of time.

RIM and military businesses was a

preferable focus. Could things

40% really have changed that much

between 2006 and 2013, or was

35% BAe responding to the trend for

diversification? Strong business

30% leaders look to the long-term and

ignore fads and fashions among

25% stock-market analysts and

management consultants.

20%

Following the leader

15%

The third herd behavior to avoid

10% is “followership.” This occurs

when companies develop “me-too”

5% products to imitate market

innovators. Of course, if a business

0% already has a genuinely

2009 2010 2011 2012 2013

differentiated offering, it is wise to

follow a new trend. Often, though,

It makes sense for the share-buying but little mention of long-standing businesses rush out copycat

public not to follow mass trends, research, which suggests that 60 products to demonstrate that they

but is the same true for business to 66 percent of all takeovers are staying competitive in a sector.

leaders? In 2008, US mass-media destroy shareholder value for the When the iPhone was launched in

corporation AOL, noticing the winning company. In other words, 2007, Nokia could boast more than

growth in social network sites, most takeover bids prove to be 40 percent of the global smartphone

bought the social-networking site a disappointment. market. Despite a series of new

Bebo for $850 million. It joined the The second herd behavior to product launches by the company,

herd and lost out badly. In 2013, it ignore is the strategic clash between

sold the same business back to its focus and diversification, and the

founders for $1 million. way the market tends to concentrate

on one of these two at any one time.

Following trends When “focus” is the market mantra,

Business leaders, then, must be share prices rise in companies that Those entrapped by the

as cautious as anyone else about sell off peripheral assets or divisions herd instinct are drowned

treading the same path as the of the business. This is what in the deluges of history.

majority. There are three main happened to British Aerospace But there are always the

types of herd to ignore. The first, (BAe) when it sold its 20 percent few who observe, reason,

as mentioned, is the occasional stake in the Airbus aircraft business and take precautions,

stampede to make takeover bids. in 2006. At the time, the stock and thus escape the flood.

In this case, business leaders worry market liked its $2.99 (£1.87) billion Anthony C. Sutton

that if they do not buy a rival, sale of the largely civilian aircraft

UK economist (1925–2002)

someone else will and perhaps maker, since it focused BAe on the

create a bigger, more difficult defense and military sector. By 2013,

competitor. At such times, there is this view looked absurd, as Airbus

much talk of synergies (the sum powered ahead but governments—

being worth more than the parts) especially the US—cut back on