Page 152 - (DK) The Business Book

P. 152

150

DEBT IS THE

WORST POVERTY

LEVERAGE AND EXCESS RISK

n 2012, US theoretical noted the importance that central

IN CONTEXT physicist Mark Buchanan banks (and governments) place on

I wrote Forecast, a book inflation, interest rates, exchange

FOCUS

detailing his investigations into rates, and consumer confidence. He

Managing risk

the workings of the economy. In was puzzled by the absence of one

KEY DATES assessing the variables that affect variable that had proved a central

1970–2008 Banks in economic growth and decline, he factor in past extremes of boom and

developed countries double

the ratio of loans that they

issue compared to the value

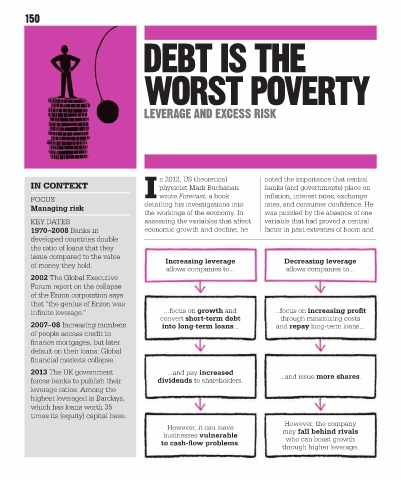

Increasing leverage Decreasing leverage

of money they hold.

allows companies to... allows companies to...

2002 The Global Executive

Forum report on the collapse

of the Enron corporation says

that “the genius of Enron was

infinite leverage.” ...focus on growth and ...focus on increasing profit

convert short-term debt through minimizing costs

2007–08 Increasing numbers into long-term loans... and repay long-term loans...

of people access credit to

finance mortgages, but later

default on their loans. Global

financial markets collapse.

2013 The UK government ...and pay increased ...and issue more shares.

forces banks to publish their dividends to shareholders.

leverage ratios. Among the

highest leveraged is Barclays,

which has loans worth 35

times its (equity) capital base.

However, the company

However, it can leave

businesses vulnerable may fall behind rivals

who can boost growth

to cash-flow problems.

through higher leverage.