Page 154 - (DK) The Business Book

P. 154

152

15 2

CASH IS KING

PROFIT VERSUS CASH FLOW

or new businesses, fast- practice it can lead to a huge

IN CONTEXT growing companies, and in cash shortfall. For example, if a

F times of recession, cash is construction business links its

FOCUS

king. In other words, profit takes a costs to the time when the finished

Financial management

back seat, while cash flow becomes houses are ready for purchase,

KEY DATES the critical factor. In accounting, it has ignored the huge cash

1957 John Meyer and Ed Kuh profit is an abstract concept based outflows that are incurred during

publish “The Investment on matching costs to the revenues the building process, and might

Decision,” the first study to generated within a period of run out of cash before the houses

look at cash flow and trading. This sounds fine, but in are sold. When times are good, a

investment in businesses.

1987 The US Financial

Accounting Standard Board

(FASB) introduces a new

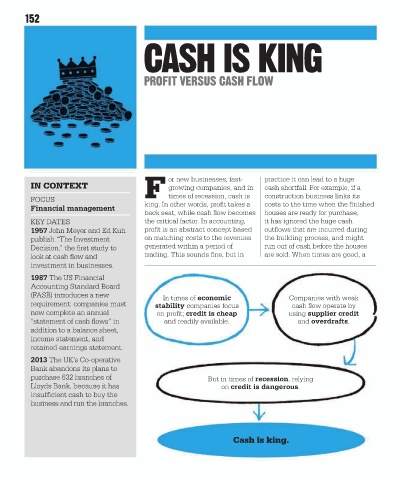

In times of economic Companies with weak

requirement: companies must stability companies focus cash flow operate by

now complete an annual on profit; credit is cheap using supplier credit

“statement of cash flows” in and readily available. and overdrafts.

addition to a balance sheet,

income statement, and

retained earnings statement.

2013 The UK’s Co-operative

Bank abandons its plans to

purchase 632 branches of But in times of recession, relying

Lloyds Bank, because it has on credit is dangerous.

insufficient cash to buy the

business and run the branches.

Cash is king.