Page 105 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 105

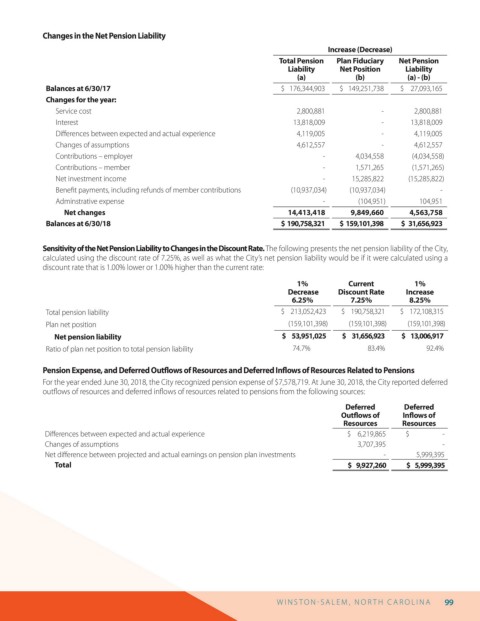

Changes in the Net Pension Liability

Increase (Decrease)

Total Pension Plan Fiduciary Net Pension

Liability Net Position Liability

(a) (b) (a) - (b)

Balances at 6/30/17 $ 176,344,903 $ 149,251,738 $ 27,093,165

Changes for the year:

Service cost 2,800,881 - 2,800,881

Interest 13,818,009 - 13,818,009

Di erences between expected and actual experience 4,119,005 - 4,119,005

Changes of assumptions 4,612,557 - 4,612,557

Contributions – employer - 4,034,558 (4,034,558)

Contributions – member - 1,571,265 (1,571,265)

Net investment income - 15,285,822 (15,285,822)

Bene t payments, including refunds of member contributions (10,937,034) (10,937,034) -

Adminstrative expense - (104,951) 104,951

Net changes 14,413,418 9,849,660 4,563,758

Balances at 6/30/18 $ 190,758,321 $ 159,101,398 $ 31,656,923

Sensitivity of the Net Pension Liability to Changes in the Discount Rate. The following presents the net pension liability of the City,

calculated using the discount rate of 7.25%, as well as what the City’s net pension liability would be if it were calculated using a

discount rate that is 1.00% lower or 1.00% higher than the current rate:

1% Current 1%

Decrease Discount Rate Increase

6.25% 7.25% 8.25%

Total pension liability $ 213,052,423 $ 190,758,321 $ 172,108,315

Plan net position (159,101,398) (159,101,398) (159,101,398)

Net pension liability $ 53,951,025 $ 31,656,923 $ 13,006,917

Ratio of plan net position to total pension liability 74.7% 83.4% 92.4%

Pension Expense, and Deferred Out ows of Resources and Deferred In ows of Resources Related to Pensions

For the year ended June 30, 2018, the City recognized pension expense of $7,578,719. At June 30, 2018, the City reported deferred

out ows of resources and deferred in ows of resources related to pensions from the following sources:

Deferred Deferred

Out ows of In ows of

Resources Resources

Di erences between expected and actual experience $ 6,219,865 $ -

Changes of assumptions 3,707,395 -

Net di erence between projected and actual earnings on pension plan investments - 5,999,395

Total $ 9,927,260 $ 5,999,395

W I N S T O N S AL E M , N O R T H C AR O L I N A 99