Page 103 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 103

Investments

Investment Policy. City Council has adopted an Investment Policy for all City funds inclusive of the investment of the retirement

fund. The City Manager, with recommendation from the Chief Financial O cer and City Treasurer, has the authority, with the

assistance of nancial consultants, to select and employ asset managers to direct investment activities of WSPORS in accordance

with the Investment Policy. The City has nine equity managers, two xed income managers, and four index funds, whose

performance is measured against appropriate market indices. Financial consultants are approved by City Council to assist the City

in the selection and oversight of asset managers. Alex. Brown a Division of Raymond James serves as the nancial consultant that

helps select and monitor the performance of WSPORS equity and xed income asset managers.

Asset allocation is a strategy that attempts to balance risk versus reward by adjusting the percentage of each asset in an investment

portfolio. Based on the principle that asset types perform di erently in di erent market and economic conditions, asset allocation

is an important factor in determining returns for an investment portfolio. Target asset allocations are set by ranges by the Chief

Financial O cer and City Treasurer with the assistance of the nancial consultant and adjusted within those ranges from time to

time to adjust for market conditions.

Concentrations. The pension plan does not hold 5% or more of the pension plan’s duciary net position (other than those issued

or explicitly guaranteed by the U.S. government) in any one organization.

Rate of Return. For the year ended June 30, 2018, the annual money-weighted rate of return on pension plan investments, net of

pension plan investment expense was 10.94%. The money-weighted rate of return expresses investment performance, net of

investment expense, adjusted for the changing amounts actually invested.

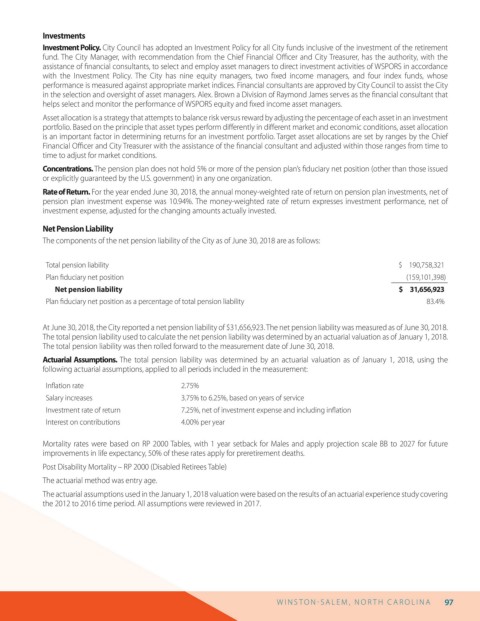

Net Pension Liability

The components of the net pension liability of the City as of June 30, 2018 are as follows:

Total pension liability $ 190,758,321

Plan duciary net position (159,101,398)

Net pension liability $ 31,656,923

Plan duciary net position as a percentage of total pension liability 83.4%

At June 30, 2018, the City reported a net pension liability of $31,656,923. The net pension liability was measured as of June 30, 2018.

The total pension liability used to calculate the net pension liability was determined by an actuarial valuation as of January 1, 2018.

The total pension liability was then rolled forward to the measurement date of June 30, 2018.

Actuarial Assumptions. The total pension liability was determined by an actuarial valuation as of January 1, 2018, using the

following actuarial assumptions, applied to all periods included in the measurement:

In ation rate 2.75%

Salary increases 3.75% to 6.25%, based on years of service

Investment rate of return 7.25%, net of investment expense and including in ation

Interest on contributions 4.00% per year

Mortality rates were based on RP 2000 Tables, with 1 year setback for Males and apply projection scale BB to 2027 for future

improvements in life expectancy, 50% of these rates apply for preretirement deaths.

Post Disability Mortality – RP 2000 (Disabled Retirees Table)

The actuarial method was entry age.

The actuarial assumptions used in the January 1, 2018 valuation were based on the results of an actuarial experience study covering

the 2012 to 2016 time period. All assumptions were reviewed in 2017.

W I N S T O N S AL E M , N O R T H C AR O L I N A 97