Page 104 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 104

Changes in Actuarial Assumptions. The following assumption changes were made since the prior valuation:

1. Update of mortality table from 2017 Table to RP 2000 Table.

2. Salary increases updated.

3. Actuarial experience study completed.

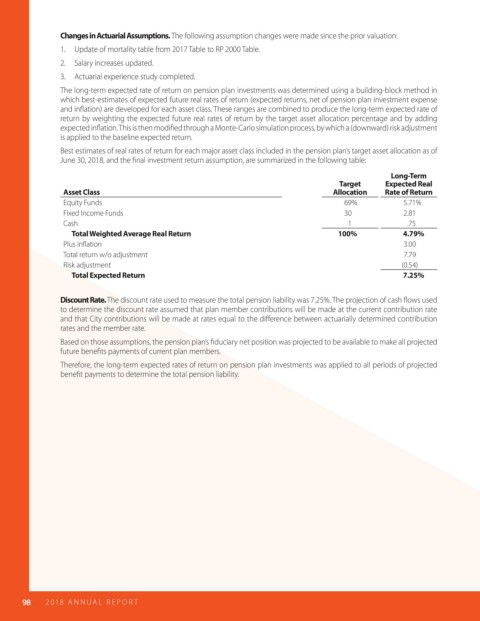

The long-term expected rate of return on pension plan investments was determined using a building-block method in

which best-estimates of expected future real rates of return (expected returns, net of pension plan investment expense

and in ation) are developed for each asset class. These ranges are combined to produce the long-term expected rate of

return by weighting the expected future real rates of return by the target asset allocation percentage and by adding

expected in ation. This is then modi ed through a Monte-Carlo simulation process, by which a (downward) risk adjustment

is applied to the baseline expected return.

Best estimates of real rates of return for each major asset class included in the pension plan’s target asset allocation as of

June 30, 2018, and the nal investment return assumption, are summarized in the following table:

Long-Term

Target Expected Real

Asset Class Allocation Rate of Return

Equity Funds 69% 5.71%

Fixed Income Funds 30 2.81

Cash 1 .75

Total Weighted Average Real Return 100% 4.79%

Plus in ation 3.00

Total return w/o adjustment 7.79

Risk adjustment (0.54)

Total Expected Return 7.25%

Discount Rate. The discount rate used to measure the total pension liability was 7.25%. The projection of cash ows used

to determine the discount rate assumed that plan member contributions will be made at the current contribution rate

and that City contributions will be made at rates equal to the di erence between actuarially determined contribution

rates and the member rate.

Based on those assumptions, the pension plan’s duciary net position was projected to be available to make all projected

future bene ts payments of current plan members.

Therefore, the long-term expected rates of return on pension plan investments was applied to all periods of projected

bene t payments to determine the total pension liability.

98 2018 AN NUAL R E P O R T