Page 34 - mutual-fund-insight - Mar 2021_Neat

P. 34

COVER STORY

the risk become too much?

There’s no one-size-fits-all

*YLKP[ YPZR M\UKZ HZ WSHJLK VU [OL answer to that. It has to be an

YPZR V TL[LY outcome of your investing needs.

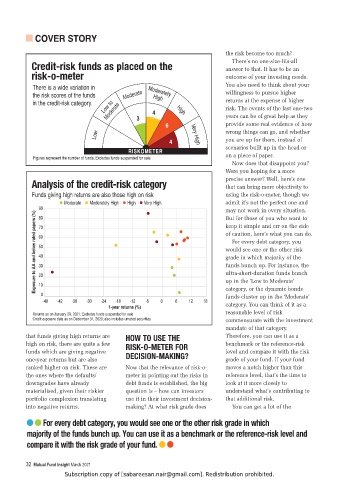

There is a wide variation in Moderately You also need to think about your

the risk scores of the funds Moderate High willingness to pursue higher

Low to High risk. The events of the last one-two

in the credit-risk category. returns at the expense of higher

Moderate

years can be of great help as they

provide some real evidence of how

Low Very High wrong things can go, and whether

you are up for them, instead of

scenarios built up in the head or

RISKOMETER

Figures represent the number of funds; Excludes funds suspended for sale on a piece of paper.

Now does that disappoint you?

Were you hoping for a more

(UHS`ZPZ VM [OL JYLKP[ YPZR JH[LNVY` precise answer? Well, here’s one

that can bring more objectivity to

Funds giving high returns are also those high on risk using the risk-o-meter, though we

z Moderate z Moderately High z High z Very High admit it’s not the perfect one and

Exposure to AA and below rated papers (%) 90 of caution, here’s what you can do.

may not work in every situation.

But for those of you who want to

80

keep it simple and err on the side

70

60

For every debt category, you

50

would see one or the other risk

40

grade in which majority of the

funds bunch up. For instance, the

30

ultra-short-duration funds bunch

20

10

category, or the dynamic bonds

0

funds cluster up in the ‘Moderate’

-48 -42 -36 -30 -24 -18 -12 -6 0 6 12 18 up in the ‘Low to Moderate’

category. You can think of it as a

1-year returns (%)

Returns as on January 29, 2021; Excludes funds suspended for sale reasonable level of risk

Credit exposure data as on December 31, 2020; also includes unrated securities commensurate with the investment

mandate of that category.

that funds giving high returns are /6> ;6 <:, ;/, Therefore, you can use it as a

high on risk, there are quite a few 90:2 6 4,;,9 -69 benchmark or the reference-risk

funds which are giving negative level and compare it with the risk

one-year returns but are also +,*0:065 4(205.& grade of your fund. If your fund

ranked higher on risk. These are Now that the relevance of risk-o- moves a notch higher than this

the ones where the defaults/ meter in pointing out the risks in reference level, that’s the time to

downgrades have already debt funds is established, the big look at it more closely to

materialised, given their riskier question is – how can investors understand what’s contributing to

portfolio complexion translating use it in their investment decision- that additional risk.

into negative returns. making? At what risk grade does You can get a lot of the

-VY L]LY` KLI[ JH[LNVY` `V\ ^V\SK ZLL VUL VY [OL V[OLY YPZR NYHKL PU ^OPJO

THQVYP[` VM [OL M\UKZ I\UJO \W @V\ JHU \ZL P[ HZ H ILUJOTHYR VY [OL YLMLYLUJL YPZR SL]LS HUK

JVTWHYL P[ ^P[O [OL YPZR NYHKL VM `V\Y M\UK

32 Mutual Fund Insight March 2021

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.