Page 36 - mutual-fund-insight - Mar 2021_Neat

P. 36

CATEGORY WATCH

ELSS: The perfect long-term

companion

Despite outflows in recent months, the AUM of tax-saving funds has continued

to climb to cross `1 lakh crore

he category of equity-linked months. A closer look reveals that ally meant for long-term invest-

saving schemes, or tax-sav- this has resulted from slower ments. One could have earned

Ting funds, is chugging inflows at the gross level, coupled negative returns in a block of three

along. It continued to be the with accelerated outflows. years during the recent market fall

third-largest category by AUM Although it is in line with the triggered by the nationwide lock-

among equity funds as on broader trend witnessed among down. However, in that case, the

December 31, 2020, managing equity funds, a reversal is expected lowest category median on a sev-

more assets than ever. Buoyed by in this last quarter of the financial en-year basis would have been

the momentum in equity markets, year when inflows have tradition- 7.80 per cent per annum.

the AUM of this category has ally peaked.

recently crossed the mark of `1 The dwindling popularity of ELSS

lakh crore. Although the category Invest with a long-term horizon With the possibility of some tax-

touched this level one year ago as Irrespective of the noise around payers opting for the alternate tax

well, it was short-lived, owing to outflows, ELSS funds continue to regime, the popularity of ELSS

the pandemic-induced market fall. be the most preferred tax-saving funds may get dented. Introduced

The ELSS category has achieved alternative for long-term investors. in the previous year’s Budget, the

this feat despite the fact that it has The roller-coaster markets of 2020 alternate tax regime has a lower tax

been experiencing net outflows for should not deter you from invest- rate but does not allow most of the

the past four months. That’s some- ing in these funds provided that tax deductions that are otherwise

thing you don’t see often in this you have time by your side. Even available, including the `1.5 lakh

category, certainly not of the mag- though ELSS funds have a lock-in deduction under Section 80C.

nitude being seen in recent period of three years, they are ide- Some investors ask if there’s

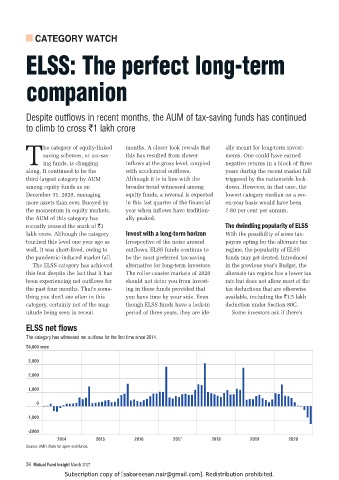

,3:: UL[ MSV^Z

The category has witnessed net outflows for the first time since 2014.

` 4,000 crore

3,000

2,000

1,000

0

-1,000

-2000

2014 2015 2016 2017 2018 2019 2020

Source: AMFI. Data for open-end funds.

34 Mutual Fund Insight March 2021

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.