Page 39 - mutual-fund-insight - Mar 2021_Neat

P. 39

FUND ADITYA BIRLA SUN LIFE TAX RELIEF 96 REGULAR DIRECT

ANALYST’S

CH ICE The aggressive choice

Launch aunched in 1996, this fund is most tenured fund managers in the

March 1996 one of the oldest in the category ELSS category.

Fund manager Land has beaten an average peer The fund follows a multi-cap

Ajay Garg

in as many as 14 years of the 24 strategy and its philosophy is to own a

complete calendar years witnessed by well-diversified portfolio of high-

it. In the process, it has compounded quality businesses. The stock selection

Expense ratio (%) its investors’ money at over 20 per is bottom-up, with an emphasis on

DIRECT cent per annum during this period. companies having strong moats. The

0.94 1.15

MIN FUND MEDIAN MAX While the fund has underperformed fund also integrates ESG

its peers in the last couple of years, (environmental, social and

0.25 2.04 we believe investors need to be governance) factors into portfolio

REGULAR patient given its illustrious long-term construction. But unlike most of its

1.86 2.28

MIN FUND MEDIAN MAX performance record. This has also peers in the category, this fund

been the period when the features sizeable exposure to mid

1.62 2.58

performance of mid and small caps, in caps, as well as select MNC stocks.

Trailing returns (%) which the fund invests substantially, Most of the time over the last five

Regular Direct S&P BSE 500 TRI has been much more muted in years, over 50 per cent of its assets

comparison with large caps. have remained invested in mid- and

10.21 Besides, it stands out for the small-cap stocks.

1-Year 11.15 stability of its fund manager. Ajay This fund is for aggressive

16.46

Garg has been managing it for 14 investors, who want sizeable exposure

3.98 years now, making him one of the to mid/small caps in their tax saver.

3-Year 5.01

6.76

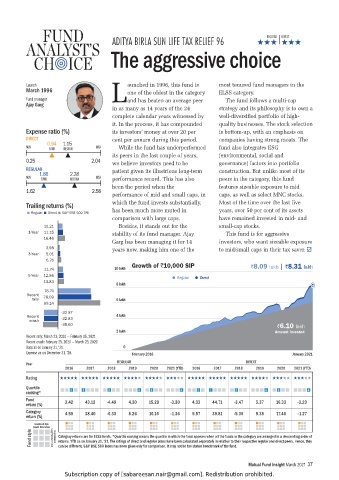

Growth of `10,000 SIP `8.09 lakh | `8.31 lakh

11.74 10 lakh

5-Year 12.86 Regular Direct

13.83

8 lakh

76.74

Recent 78.09

rally 6 lakh

99.14

-32.87

Recent -32.83 4 lakh

crash

-35.60 `6.10 lakh

2 lakh Amount invested

Recent rally: March 23, 2020 — February 05, 2021

Recent crash: February 25, 2020 — March 23, 2020

Data as on January 31, ‘21. 0

Expense as on December 31, ‘20. February 2016 January 2021

REGULAR DIRECT

Year

2016 2017 2018 2019 2020 2021 (YTD) 2016 2017 2018 2019 2020 2021 (YTD)

Rating

Quartile 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4

ranking*

Fund 3.42 43.12 -4.49 4.30 15.29 -3.30 4.33 44.71 -3.47 5.37 16.33 -3.23

return (%)

Category 4.58 38.40 -6.33 8.26 16.16 -1.36 5.57 39.81 -5.35 9.38 17.46 -1.27

return (%)

Investment style

Fund style Growth Blend Value Large Medium Small Capitalisation Category returns are for ELSS funds. *Quartile ranking means the quartile in which the fund appears when all the funds in the category are arranged in a descending order of

returns. YTD as on January 31, ’21. The ratings of direct and regular plans have been calculated separately in relation to their respective regular and direct peers. Hence, they

can be different. S&P BSE 500 index has been given only for comparison. It may not be the stated benchmark of the fund.

Mutual Fund Insight March 2021 37

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.