Page 59 - mutual-fund-insight - Mar 2021_Neat

P. 59

For more on funds, visit www.valueresearchonline.com

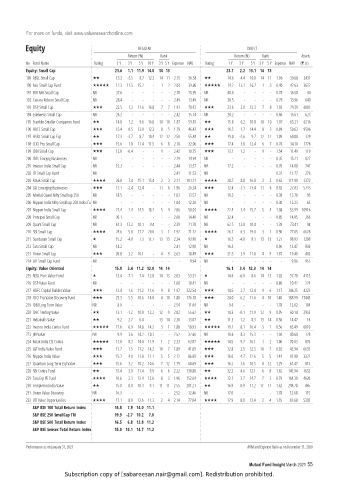

Equity REGULAR DIRECT

Return (%) Rank Return (%) Rank Assets

No Fund Name Rating 1 Y 3 Y 5 Y 10 Y 3 Y 5 Y Expense NAV Rating 1 Y 3 Y 5 Y 3 Y 5 Y Expense NAV (` cr)

Equity: Small Cap 21.6 1.1 11.9 14.0 14 13 23.1 2.2 13.1 14 13

189 ABSL Small Cap 13.2 -5.5 8.7 12.3 14 11 2.15 36.58 14.6 -4.4 10.0 14 11 1.06 39.68 2431

190 Axis Small Cap Fund 12.3 11.5 15.2 - 1 2 2.03 39.06 14.2 13.1 16.7 1 3 0.40 42.63 3632

191 BOI AXA Small Cap NR 37.6 - - - - - 2.70 15.95 NR 40.0 - - - - 0.78 16.58 94

192 Canara Robeco Small Cap NR 28.4 - - - - - 2.49 13.49 NR 30.5 - - - - 0.79 13.96 640

193 DSP Small Cap 22.5 1.2 11.6 16.8 7 7 1.91 70.43 23.6 2.0 12.3 7 8 1.02 74.39 6001

194 Edelweiss Small Cap NR 26.2 - - - - - 2.42 15.14 NR 28.2 - - - - 0.86 15.61 623

195 Franklin Smaller Companies Fund 14.8 -1.2 9.6 16.0 10 10 1.87 59.81 15.8 -0.2 10.8 10 10 1.07 65.21 6216

196 HDFC Small Cap 15.4 0.5 13.0 12.3 8 5 1.79 46.43 16.5 1.7 14.4 8 5 0.89 50.63 9596

197 HSBC Small Cap Eqt 17.3 -3.7 8.7 10.4 12 12 2.50 55.84 19.0 -2.6 9.7 12 12 1.09 60.00 329

198 ICICI Pru Small Cap 15.6 1.8 11.4 11.5 6 8 2.18 32.06 17.4 3.0 12.4 6 7 0.76 34.10 1778

199 IDBI Small Cap 12.0 -0.4 - - 9 - 2.42 10.75 13.1 1.2 - 9 - 1.54 11.49 119

200 IDFC Emrgng Businesses NR - - - - - - 2.29 14.94 NR - - - - - 0.35 15.21 827

201 Invesco India Small Cap NR 15.3 - - - - - 2.44 13.57 NR 17.2 - - - - 0.70 14.08 747

202 ITI Small Cap Fund NR - - - - - - 2.41 11.53 NR - - - - - 0.31 11.77 276

203 Kotak Small Cap 26.8 7.4 15.1 15.4 2 3 2.11 101.11 28.7 8.8 16.8 2 2 0.62 111.98 2372

204 L&T Emerging Businesses 11.1 -2.4 12.4 - 11 6 1.96 26.24 12.4 -1.3 13.4 11 6 0.82 27.83 5733

205 Motilal Oswal Nifty Smallcap 250 NR 18.5 - - - - - 1.03 13.57 NR 19.3 - - - - 0.38 13.70 95

206 Nippon India Nifty Smallcap 250 Index Fu NR - - - - - - 1.04 12.20 NR - - - - - 0.30 12.23 63

207 Nippon India Small Cap 21.4 2.4 14.5 18.1 5 4 2.06 50.03 22.4 3.4 15.7 5 4 1.08 53.99 10916

208 Principal Small Cap NR 30.1 - - - - - 2.60 14.40 NR 32.4 - - - - 0.85 14.85 266

209 Quant Small Cap NR 61.3 12.2 10.1 9.4 - - 2.39 71.70 NR 62.5 12.8 10.4 - - 1.39 73.41 94

210 SBI Small Cap 24.6 5.0 17.7 20.0 3 1 1.92 71.12 26.1 6.3 19.0 3 1 0.90 77.85 6628

211 Sundaram Small Cap 15.2 -4.8 7.3 11.7 13 13 2.24 93.90 16.3 -4.0 8.1 13 13 1.27 98.93 1208

212 Tata Small Cap NR 14.2 - - - - - 2.41 12.90 NR 16.3 - - - - 0.96 13.47 836

213 Union Small Cap 20.8 3.2 10.1 - 4 9 2.63 18.49 21.5 3.9 11.0 4 9 1.87 19.48 402

214 UTI Small Cap Fund NR - - - - - - - 9.94 NR - - - - - - 9.96 951

Equity: Value Oriented 15.0 2.4 11.2 12.0 14 14 16.1 3.4 12.3 14 14

215 ABSL Pure Value Fund 13.4 -7.1 7.4 12.8 14 13 2.03 53.31 14.6 -6.0 8.6 14 13 1.02 57.70 4115

216 DSP Value Fund NR - - - - - - 1.60 10.41 NR - - - - - 0.80 10.42 224

217 HDFC Capital Builder Value 13.4 1.6 11.2 11.6 9 8 1.97 322.54 14.5 2.7 12.4 9 6 1.17 346.25 4323

218 ICICI Pru Value Discovery Fund 23.3 5.5 10.6 14.0 4 10 1.80 176.18 24.0 6.2 11.6 4 10 1.40 188.99 17443

219 IDBI Long Term Value NR 8.9 - - - - - 2.54 11.64 NR 9.6 - - - - 1.78 12.02 104

220 IDFC Sterling Value 13.1 -1.2 10.8 12.2 12 9 2.02 55.67 14.3 -0.1 11.9 12 9 0.95 60.14 2953

221 Indiabulls Value 9.2 -2.7 6.4 - 13 14 2.30 13.07 11.3 -1.2 8.3 13 14 0.50 14.47 16

222 Invesco India Contra Fund 17.6 6.9 14.8 14.2 3 1 1.88 58.93 19.1 8.1 16.4 3 1 0.56 65.49 6010

223 JM Value NR 9.9 3.6 14.2 10.3 - - 2.52 37.66 NR 10.6 4.3 15.3 - - 1.50 40.64 128

224 Kotak India EQ Contra 13.0 8.3 14.4 11.9 1 2 2.33 63.07 14.5 9.7 16.1 1 2 1.00 70.03 876

225 L&T India Value Fund 11.7 1.5 11.2 14.2 10 7 1.89 41.09 12.8 2.5 12.3 10 7 0.92 43.94 6635

226 Nippon India Value 15.2 4.0 11.8 11.1 5 5 2.12 86.69 16.0 4.7 12.6 5 5 1.44 91.99 3322

227 Quantum Long Term Eqt Value 15.6 3.2 10.2 10.6 7 12 1.79 60.69 16.2 3.6 10.5 8 12 1.29 61.47 813

228 SBI Contra Fund 31.4 3.9 11.4 9.9 6 6 2.22 138.80 32.2 4.6 12.1 6 8 1.65 145.94 1652

229 Tata Eqt PE Fund 10.6 2.3 13.4 12.6 8 3 1.96 152.64 12.1 3.7 14.7 7 3 0.79 164.30 4620

230 Templeton India Value 15.8 0.0 10.3 9.1 11 11 2.55 281.21 16.9 0.9 11.2 11 11 1.62 298.70 465

231 Union Value Discovery NR 16.3 - - - - - 2.52 12.46 NR 17.0 - - - - 1.78 12.68 115

232 UTI Value Opportunities 17.1 8.0 12.6 11.3 2 4 2.14 77.04 17.9 8.8 13.4 2 4 1.35 81.68 5202

S&P BSE 100 Total Return Index 15.8 7.9 14.0 11.1

S&P BSE 250 SmallCap TRI 19.9 -2.7 10.2 7.0

S&P BSE 500 Total Return Index 16.5 6.8 13.8 11.2

S&P BSE Sensex Total Return Index 15.0 10.1 14.7 11.2

Performance as on January 31, 2021 AUM and Expense Ratio as on December 31, 2020

Mutual Fund Insight March 2021 55

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.