Page 62 - mutual-fund-insight - Mar 2021_Neat

P. 62

For more on funds, visit www.valueresearchonline.com

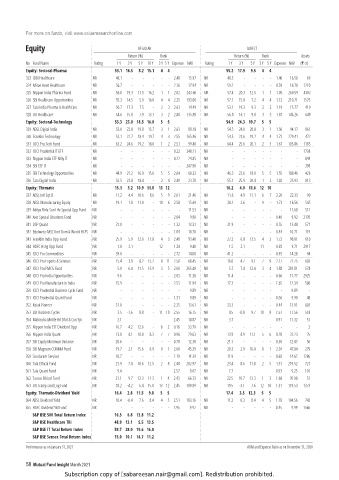

Equity REGULAR DIRECT

Return (%) Rank Return (%) Rank Assets

No Fund Name Rating 1 Y 3 Y 5 Y 10 Y 3 Y 5 Y Expense NAV Rating 1 Y 3 Y 5 Y 3 Y 5 Y Expense NAV (` cr)

Equity: Sectoral-Pharma 53.1 16.5 8.2 15.1 4 4 55.2 17.9 9.5 4 4

323 IDBI Healthcare NR 46.1 - - - - - 2.48 15.97 NR 48.5 - - - - 1.40 16.50 69

324 Mirae Asset Healthcare NR 56.7 - - - - - 2.16 17.94 NR 59.2 - - - - 0.59 18.70 1210

325 Nippon India Pharma Fund NR 56.0 19.3 11.5 16.2 1 1 2.02 243.66 NR 57.4 20.3 12.5 1 1 1.05 260.59 4383

326 SBI Healthcare Opportunities NR 55.3 14.5 5.9 16.0 4 4 2.25 193.00 NR 57.1 15.8 7.2 4 4 1.12 210.71 1575

327 Tata India Pharma & HealthCare NR 50.7 17.3 7.5 - 2 3 2.63 14.49 NR 53.1 19.3 9.3 2 2 1.19 15.77 419

328 UTI Healthcare NR 54.6 15.0 7.9 13.1 3 2 2.80 135.89 NR 56.0 16.1 9.0 3 3 1.81 146.26 649

Equity: Sectoral-Technology 53.3 23.0 18.5 16.0 5 5 54.9 24.3 19.7 5 5

329 ABSL Digital India NR 53.0 22.8 19.8 15.7 3 1 2.63 88.18 NR 54.5 24.0 20.8 3 1 1.50 94.17 861

330 Franklin Technology NR 53.1 22.7 18.4 14.7 4 3 2.55 265.46 NR 54.5 23.6 19.2 4 4 1.73 279.41 472

331 ICICI Pru Tech Fund NR 63.2 24.6 19.2 18.0 1 2 2.53 99.40 NR 64.4 25.6 20.1 2 3 1.67 105.86 1185

332 ICICI Prudential IT ETF NR - - - - - - 0.22 248.11 NR - - - - - - - 1738

333 Nippon India ETF Nifty IT NR - - - - - - 0.22 24.85 NR - - - - - - - 844

334 SBI ETF IT NR - - - - - - - 247.90 NR - - - - - - - 309

335 SBI Technology Opportunities NR 44.9 21.2 16.9 15.6 5 5 2.64 60.32 NR 46.3 22.6 18.0 5 5 1.55 108.46 426

336 Tata Digital India NR 52.5 23.8 18.4 - 2 4 2.49 23.78 NR 55.1 25.9 20.4 1 2 1.02 25.93 813

Equity: Thematic 15.1 3.2 10.9 11.8 13 12 16.2 4.0 11.6 12 10

337 ABSL Intl Eqt B NR 11.2 4.4 10.6 8.6 5 9 2.61 21.46 NR 11.6 4.9 11.1 6 7 2.26 22.33 90

338 ABSL Manufacturing Equity NR 19.1 1.8 11.0 - 10 6 2.58 15.69 NR 20.1 2.6 - 9 - 1.73 16.56 545

339 Aditya Birla Sun Life Special Opp Fund NR - - - - - - - 11.53 NR - - - - - - 11.60 512

340 Axis Special Situations Fund NR - - - - - - 2.04 9.90 NR - - - - - 0.40 9.92 2170

341 DSP Quant NR 21.0 - - - - - 1.32 13.31 NR 21.9 - - - - 0.55 13.48 571

342 Edelweiss MSCI Ind Dom & World HC45 NR - - - - - - 1.04 10.70 NR - - - - - 0.44 10.71 119

343 Franklin India Opp Fund NR 25.9 5.9 12.6 11.8 4 3 2.48 93.40 NR 27.2 6.8 13.5 4 2 1.72 98.81 610

344 HDFC Hsng Opp Fund NR 1.0 -3.1 - - 12 - 1.34 9.40 NR 1.5 -2.1 - 11 - 0.83 9.71 2917

345 ICICI Pru Commodities NR 39.0 - - - - - 2.72 14.00 NR 41.2 - - - - 0.93 14.28 94

346 ICICI Pru Exports & Services NR 15.4 3.9 8.2 15.2 8 11 2.58 68.45 NR 16.0 4.7 9.1 7 9 2.17 72.75 603

347 ICICI Pru FMCG Fund NR 5.0 6.4 11.5 15.9 3 5 2.60 265.49 NR 5.7 7.4 12.4 3 4 1.88 281.81 574

348 ICICI Pru India Opportunities NR 9.6 - - - - - 2.03 11.38 NR 11.4 - - - - 0.66 11.77 2925

349 ICICI Pru Manufacture in India NR 15.9 - - - - - 2.53 11.94 NR 17.3 - - - - 1.65 12.34 580

350 ICICI Prudential Business Cycle Fund NR - - - - - - - 9.89 NR - - - - - - 9.89 -

351 ICICI Prudential Quant Fund NR - - - - - - 1.31 9.89 NR - - - - - 0.56 9.90 48

352 Kotak Pioneer NR 31.0 - - - - - 2.25 13.61 NR 33.3 - - - - 0.44 13.91 803

353 L&T Business Cycles NR 3.5 -1.6 8.8 - 11 10 2.55 16.75 NR 4.5 -0.8 9.7 10 8 1.57 17.56 518

354 Mahindra Mnlife Rrl Bhrt & Con Yjn NR 2.1 - - - - - 2.45 10.87 NR 3.7 - - - - 0.91 11.32 51

355 Nippon India ETF Dividend Opp NR 16.7 4.2 12.6 - 6 2 0.16 33.79 NR - - - - - - - 2

356 Nippon India Quant NR 13.0 4.1 10.8 8.3 7 7 0.96 29.63 NR 13.9 4.9 11.1 5 6 0.20 31.23 25

357 SBI Equity Minimum Variance NR 20.6 - - - - - 0.70 12.38 NR 21.1 - - - - 0.30 12.47 56

358 SBI Magnum COMMA Fund NR 19.7 2.1 15.6 6.9 9 1 2.60 45.39 NR 20.3 2.9 16.4 8 1 2.01 47.84 279

359 Sundaram Services NR 10.7 - - - - - 2.19 14.34 NR 11.9 - - - - 0.68 14.67 1286

360 Tata Ethical Fund NR 21.9 7.4 10.6 12.5 2 8 2.48 202.97 NR 23.4 8.6 11.8 2 5 1.31 219.52 721

361 Tata Quant Fund NR -9.4 - - - - - 2.57 9.07 NR -7.7 - - - - 0.93 9.25 101

362 Taurus Ethical Fund NR 21.1 9.7 12.3 11.3 1 4 2.43 66.33 NR 22.5 10.7 13.3 1 3 1.68 70.98 51

363 UTI Transp and Log Fund NR 18.2 -4.2 6.4 15.8 13 12 2.45 109.89 NR 19.5 -3.1 7.6 12 10 1.31 119.53 1373

Equity: Thematic-Dividend Yield 16.4 2.8 11.5 9.8 5 5 17.4 3.5 12.3 5 5

364 ABSL Dividend Yield NR 10.4 -0.4 7.6 8.4 4 5 2.51 183.16 NR 11.2 0.3 8.4 4 5 1.78 194.56 742

365 HDFC Dividend Yld Fund NR - - - - - - 1.95 9.97 NR - - - - - 0.45 9.99 1566

S&P BSE 500 Total Return Index 16.5 6.8 13.8 11.2

S&P BSE Healthcare TRI 48.9 13.1 5.5 13.5

S&P BSE IT Total Return Index 59.7 28.0 19.6 16.8

S&P BSE Sensex Total Return Index 15.0 10.1 14.7 11.2

Performance as on January 31, 2021 AUM and Expense Ratio as on December 31, 2020

58 Mutual Fund Insight March 2021

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.