Page 60 - mutual-fund-insight - Mar 2021_Neat

P. 60

For more on funds, visit www.valueresearchonline.com

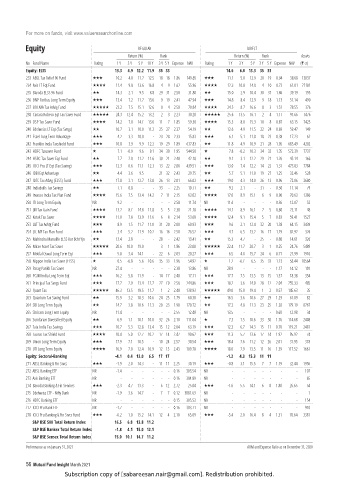

Equity REGULAR DIRECT

Return (%) Rank Return (%) Rank Assets

No Fund Name Rating 1 Y 3 Y 5 Y 10 Y 3 Y 5 Y Expense NAV Rating 1 Y 3 Y 5 Y 3 Y 5 Y Expense NAV (` cr)

Equity: ELSS 13.3 4.9 12.2 11.9 35 33 14.6 6.0 13.3 35 33

233 ABSL Tax Relief 96 Fund 10.2 4.0 11.7 12.5 18 18 1.86 149.85 11.1 5.0 12.9 20 19 0.94 38.68 13037

234 Axis LT Eqt Fund 11.4 9.8 13.6 16.8 4 9 1.62 55.96 12.3 10.8 14.8 4 10 0.73 61.01 27181

235 Baroda ELSS 96 Fund 14.3 2.1 9.5 8.8 29 31 2.58 31.80 15.0 2.9 10.4 30 31 1.86 39.19 195

236 BNP Paribas Long Term Equity 13.4 7.2 11.7 13.6 9 19 2.41 47.94 14.8 8.4 12.9 9 18 1.13 51.14 490

237 BOI AXA Tax Advtg Fund 23.2 7.5 15.1 12.6 8 4 2.58 70.84 24.5 8.7 16.6 8 3 1.51 78.55 376

238 Canara Robeco Eqt Tax Saver Fund 24.3 12.4 15.2 13.2 2 3 2.23 30.20 25.6 13.5 16.1 2 4 1.17 91.66 1476

239 DSP Tax Saver Fund 14.2 7.0 14.1 13.6 11 7 1.85 59.30 15.3 8.0 15.3 10 8 0.87 63.15 7425

240 Edelweiss LT Eqt (Tax Svngs) 10.7 3.1 10.0 11.2 25 27 2.37 54.19 12.6 4.9 11.5 22 24 0.69 59.47 149

241 Essel Long Term Advantage 4.2 3.3 10.0 - 23 28 2.33 15.83 6.1 5.1 11.8 18 23 0.38 17.23 62

242 Franklin India Taxshield Fund 10.8 3.9 9.9 12.2 19 29 1.89 637.83 11.8 4.9 10.9 21 28 1.05 685.49 4202

243 HDFC Taxsaver Fund 7.1 -0.9 9.6 9.1 34 30 1.95 544.50 7.8 -0.2 10.3 34 32 1.35 572.39 7737

244 HSBC Tax Saver Eqt Fund 7.7 2.0 11.2 11.6 30 21 2.48 42.18 9.1 3.1 12.2 29 21 1.26 45.14 166

245 ICICI Pru LT Eqt (Tax Saving) 12.3 6.6 11.1 12.3 13 22 2.06 439.51 13.0 7.4 12.2 14 22 1.31 473.83 7784

246 IDBI Eqt Advantage 4.4 3.6 9.5 - 21 32 2.43 29.75 5.7 5.1 11.0 19 27 1.25 32.46 528

247 IDFC Tax Advtg (ELSS) Fund 17.8 3.1 12.7 13.0 26 13 2.01 66.02 19.0 4.3 14.0 26 13 0.96 72.06 2680

248 Indiabulls Tax Savings 7.1 0.8 - - 33 - 2.25 10.71 9.2 2.1 - 31 - 0.50 11.14 79

249 Invesco India Tax Plan Fund 15.6 7.5 13.4 14.2 7 11 2.15 63.02 17.0 8.9 15.1 6 9 0.90 70.63 1386

250 ITI Long Term Equity NR 9.2 - - - - - 2.58 11.74 NR 11.6 - - - - 0.36 12.07 52

251 JM Tax Gain Fund 13.2 8.1 14.8 11.8 5 5 2.30 21.18 14.1 8.9 16.1 7 5 0.80 23.11 48

252 Kotak Tax Saver 11.0 7.8 13.9 11.6 6 8 2.14 53.68 12.4 9.1 15.4 5 7 0.83 59.41 1527

253 L&T Tax Advtg Fund 8.9 1.5 11.7 11.0 31 20 2.00 60.93 9.6 2.1 12.4 32 20 1.38 64.15 3439

254 LIC MF Tax Plan Fund 3.4 5.2 11.9 10.2 16 16 2.50 76.52 4.7 6.5 13.2 16 17 1.29 82.92 326

255 Mahindra Manulife ELSS Kar Bcht Yjn 13.4 2.8 - - 28 - 2.42 13.41 15.3 4.7 - 25 - 0.80 14.61 326

256 Mirae Asset Tax Saver 20.6 10.0 19.0 - 3 1 1.86 23.00 22.4 11.7 20.7 3 1 0.25 24.76 5489

257 Motilal Oswal Long Term Eqt 5.0 3.4 14.1 - 22 6 2.03 20.27 6.5 4.8 15.7 24 6 0.71 21.99 1910

258 Nippon India Tax Saver (ELSS) 0.5 -6.8 5.6 10.6 35 33 1.96 54.92 1.2 -6.1 6.5 35 33 1.13 58.44 10564

259 Parag Parikh Tax Saver NR 27.4 - - - - - 2.38 13.86 NR 28.9 - - - - 1.17 14.12 101

260 PGIM India Long Term Eqt 16.2 5.8 11.9 - 14 17 2.48 17.11 17.7 7.5 13.5 13 15 1.37 18.38 354

261 Principal Tax Svngs Fund 17.7 2.9 13.4 12.7 27 10 2.56 244.86 18.2 3.6 14.0 28 12 2.04 255.33 485

262 Quant Tax 46.3 13.5 18.5 11.7 1 2 2.48 138.93 49.0 15.0 19.4 1 2 0.57 145.63 35

263 Quantum Tax Saving Fund 15.9 3.2 10.3 10.6 24 25 1.79 60.30 16.5 3.6 10.6 27 29 1.29 61.09 82

264 SBI Long Term Equity 14.7 3.8 10.6 11.3 20 23 1.90 170.72 17.2 4.8 11.3 23 25 1.28 179.19 8767

265 Shriram Long Term Equity NR 11.4 - - - - - 2.55 12.48 NR 13.5 - - - - 0.60 12.98 34

266 Sundaram Diversified Equity 6.9 1.1 10.1 10.0 32 26 2.10 111.04 7.3 1.5 10.6 33 30 1.76 114.68 2408

267 Tata India Tax Savings 10.7 5.3 12.8 13.4 15 12 2.04 63.19 12.3 6.7 14.3 15 11 0.70 119.21 2481

268 Taurus Tax Shield Fund 10.4 5.0 12.7 10.2 17 14 2.47 90.62 11.3 5.7 13.6 17 14 1.92 95.92 74

269 Union Long Term Equity 17.9 7.1 10.5 - 10 24 2.57 30.54 18.4 7.6 11.2 12 26 2.01 31.95 318

270 UTI Long Term Equity 16.9 7.0 12.4 10.9 12 15 2.43 109.78 18.0 7.9 13.5 11 16 1.39 117.52 1661

Equity: Sectoral-Banking -4.1 0.4 12.0 6.5 17 17 -1.2 4.3 15.3 11 11

271 ABSL Banking & Fin Srvcs -1.9 2.0 14.3 - 11 11 2.25 30.19 -0.8 3.1 15.5 7 7 1.19 32.44 1956

272 ABSL Banking ETF NR -1.4 - - - - - 0.16 303.54 NR - - - - - - - 107

273 Axis Banking ETF NR - - - - - - 0.16 304.89 NR - - - - - - - 65

274 Baroda Banking & Fin Services -2.3 4.7 13.3 - 6 12 2.72 25.04 -1.6 5.5 14.1 6 8 1.80 26.65 54

275 Edelweiss ETF - Nifty Bank NR -1.9 3.6 14.7 - 7 7 0.12 3081.63 NR - - - - - - - 1

276 HDFC Banking ETF NR - - - - - - 0.15 305.53 NR - - - - - - - 154

277 ICICI Pru Bank ETF NR -1.7 - - - - - 0.16 303.71 NR - - - - - - - 910

278 ICICI Pru Banking & Fin Srvcs Fund -6.2 1.0 15.2 14.1 12 4 2.10 65.09 -5.4 2.0 16.4 8 4 1.31 70.64 3381

S&P BSE 500 Total Return Index 16.5 6.8 13.8 11.2

S&P BSE Bankex Total Return Index -1.8 4.1 15.0 12.1

S&P BSE Sensex Total Return Index 15.0 10.1 14.7 11.2

Performance as on January 31, 2021 AUM and Expense Ratio as on December 31, 2020

56 Mutual Fund Insight March 2021

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.