Page 64 - mutual-fund-insight - Mar 2021_Neat

P. 64

For more on funds, visit www.valueresearchonline.com

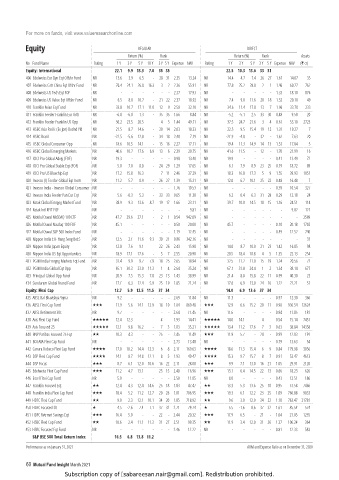

Equity REGULAR DIRECT

Return (%) Rank Return (%) Rank Assets

No Fund Name Rating 1 Y 3 Y 5 Y 10 Y 3 Y 5 Y Expense NAV Rating 1 Y 3 Y 5 Y 3 Y 5 Y Expense NAV (` cr)

Equity: International 22.1 9.9 13.3 7.0 35 35 22.5 10.3 13.6 33 31

406 Edelweiss Eur Dyn Eqt Offshr Fund NR 13.6 3.9 6.5 - 28 31 2.35 13.24 NR 14.4 4.7 7.4 26 27 1.61 14.07 35

407 Edelweiss Grtr China Eqt Ofshr Fund NR 76.4 24.1 26.8 16.3 3 2 2.36 55.91 NR 77.8 25.2 28.0 2 1 1.46 60.27 762

408 Edelweiss US Tech Eqt FOF NR - - - - - - 2.37 17.93 NR - - - - - 1.33 18.10 876

409 Edelweiss US Value Eqt Offshr Fund NR 6.5 8.0 10.7 - 21 22 2.37 18.92 NR 7.4 9.0 11.6 20 18 1.52 20.10 49

410 Franklin Asian Eqt Fund NR 33.8 10.7 17.1 11.0 12 9 2.58 32.10 NR 34.6 11.4 17.8 13 7 1.96 33.78 233

411 Franklin Feeder Franklin Eur Grth NR -6.0 -6.0 1.3 - 35 35 1.66 8.84 NR -5.2 -5.1 2.5 33 30 0.48 9.58 20

412 Franklin Feeder Franklin US Opp NR 36.2 23.5 20.5 - 4 5 1.44 49.11 NR 37.5 24.7 21.6 3 4 0.61 53.10 2723

413 HSBC Asia Pacifc (Ex Jpn) Dvdnd Yld NR 21.5 8.7 14.6 - 20 14 2.03 18.33 NR 22.5 9.5 15.4 19 12 1.31 19.27 7

414 HSBC Brazil NR -22.5 -5.6 12.8 - 34 18 2.40 7.19 NR -21.9 -4.8 - 32 - 1.62 7.63 20

415 HSBC Global Consumer Opp NR 18.6 10.5 14.1 - 15 16 2.27 17.11 NR 19.4 11.3 14.9 14 13 1.53 17.84 5

416 HSBC Global Emerging Markets NR 40.6 10.7 17.6 6.9 13 6 2.39 20.75 NR 41.6 11.5 - 12 - 1.70 21.99 16

417 ICICI Pru Global Advtg (FOF) NR 19.3 - - - - - 0.98 13.40 NR 19.9 - - - - 0.41 13.49 72

418 ICICI Pru Global Stable Eqt (FOF) NR 5.0 7.0 8.0 - 24 29 1.29 17.65 NR 6.1 7.9 8.9 23 25 0.19 18.72 89

419 ICICI Pru US Bluechip Eqt NR 17.2 15.8 16.3 - 7 11 2.46 37.29 NR 18.3 16.8 17.3 5 9 1.55 39.93 1051

420 Invesco (I) Feeder Global Eqt Incm NR 11.2 5.7 8.9 - 26 27 1.39 15.31 NR 12.0 6.7 10.1 25 22 0.48 16.48 7

421 Invesco India - Invesco Global Consumer NR - - - - - - 1.76 10.53 NR - - - - - 0.39 10.54 327

422 Invesco India Feeder Pan Eur Eqt NR 5.6 -0.3 5.3 - 33 33 0.65 11.38 NR 6.2 0.4 6.3 31 28 0.29 12.18 24

423 Kotak Global Emrgng Market Fund NR 38.9 9.3 13.6 8.7 19 17 1.66 23.11 NR 39.7 10.0 14.5 18 15 1.16 24.51 114

424 Kotak Intl REIT FOF NR - - - - - - - 9.81 NR - - - - - - 9.82 121

425 Motilal Oswal NASDAQ 100 ETF NR 47.7 29.6 27.1 - 2 1 0.54 942.09 NR - - - - - - - 2589

426 Motilal Oswal Nasdaq 100 FOF NR 45.1 - - - - - 0.50 20.00 NR 45.7 - - - - 0.10 20.18 1702

427 Motilal Oswal S&P 500 Index Fund NR - - - - - - 1.19 12.45 NR - - - - - 0.49 12.52 740

428 Nippon India ETF Hang Seng BeES NR 12.5 2.1 11.6 9.3 30 21 0.86 342.16 NR - - - - - - - 31

429 Nippon India Japan Equity NR 12.8 7.6 9.1 - 22 26 2.43 15.98 NR 14.0 8.7 10.0 21 23 1.42 16.85 98

430 Nippon India US Eqt Opportunities NR 18.9 17.1 17.6 - 5 7 2.55 20.90 NR 20.5 18.4 18.8 4 5 1.35 22.13 254

431 PGIM India Emrgng Markets Eqt Fund NR 31.4 9.9 9.7 7.9 18 25 2.65 18.94 NR 32.5 11.2 11.0 15 19 1.24 20.56 72

432 PGIM India Global Eqt Opp NR 65.1 30.3 23.0 11.3 1 4 2.64 35.24 NR 67.1 31.8 24.4 1 2 1.34 38.14 677

433 Principal Global Opp Fund NR 20.9 7.5 15.3 7.8 23 13 1.43 38.99 NR 21.4 8.0 15.8 22 11 0.99 40.30 23

434 Sundaram Global Brand Fund NR 17.1 6.3 12.4 5.9 25 19 1.85 21.24 NR 17.6 6.9 13.0 24 16 1.22 22.21 51

Equity: Flexi Cap 12.7 5.9 12.5 11.5 37 34 14.0 6.9 13.6 37 34

435 ABSL Bal Bhavishya Yojna NR 9.2 - - - - - 2.69 11.84 NR 11.3 - - - - 0.97 12.30 366

436 ABSL Flexi Cap Fund 11.9 5.6 14.1 12.9 18 10 1.84 869.48 12.9 6.6 15.2 20 11 0.98 936.54 12624

437 ABSL Retirement 30s NR 9.7 - - - - - 2.64 11.45 NR 11.6 - - - - 0.94 11.85 181

438 Axis Flexi Cap Fund 12.4 12.3 - - 4 - 1.93 14.41 14.0 14.1 - 4 - 0.54 15.14 7451

439 Axis Focused 25 12.1 9.8 16.2 - 7 3 1.83 35.21 13.4 11.2 17.6 7 3 0.63 38.84 14358

440 BNP Paribas Focused 25 Eqt 10.3 4.3 - - 25 - 2.45 11.49 11.9 5.7 - 24 - 0.99 12.03 191

441 BOI AXA Flexi Cap Fund NR - - - - - - 2.73 13.48 NR - - - - - 0.79 13.63 54

442 Canara Robeco Flexi Cap Fund 17.0 10.2 14.4 12.3 6 8 2.11 169.63 18.6 11.3 15.4 6 9 0.84 179.98 3056

443 DSP Flexi Cap Fund 14.1 8.7 14.8 12.1 8 5 1.93 49.47 15.3 9.7 15.7 8 7 0.91 53.47 4613

444 DSP Focus 8.7 6.1 12.0 10.6 16 22 2.11 28.08 9.9 7.1 13.0 16 21 1.05 29.91 2120

445 Edelweiss Flexi Cap Fund 11.2 4.7 13.1 - 23 15 2.40 16.96 13.1 6.4 14.5 22 13 0.66 18.23 626

446 Essel Flexi Cap Fund NR 5.9 - - - - - 2.50 11.85 NR 8.0 - - - - 0.43 12.51 186

447 Franklin Focused Eqt 12.4 4.3 12.4 14.6 25 18 1.83 47.47 13.3 5.3 13.6 25 18 0.95 51.58 7466

448 Franklin India Flexi Cap Fund 18.4 5.2 11.2 12.7 20 26 1.81 706.95 19.3 6.1 12.2 23 25 1.09 760.88 9033

449 HDFC Flexi Cap Fund 9.0 2.3 12.1 10.1 34 20 1.85 718.92 9.6 3.0 12.9 34 22 1.18 763.47 21781

450 HDFC Focused 30 4.5 -2.6 7.4 7.1 37 32 2.71 79.74 5.5 -1.6 8.6 37 32 1.61 85.54 574

451 HDFC Retrmnt Savings Eqt 16.4 5.0 - - 22 - 2.44 20.32 17.9 6.5 - 21 - 1.04 21.85 1235

452 HSBC Flexi Cap Fund 10.6 2.4 11.1 11.3 31 27 2.51 99.35 11.9 3.4 12.0 31 26 1.37 106.24 364

453 HSBC Focused Eqt Fund NR - - - - - - 2.46 12.22 NR - - - - - 0.81 12.33 583

S&P BSE 500 Total Return Index 16.5 6.8 13.8 11.2

Performance as on January 31, 2021 AUM and Expense Ratio as on December 31, 2020

60 Mutual Fund Insight March 2021

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.