Page 61 - mutual-fund-insight - Mar 2021_Neat

P. 61

For more on funds, visit www.valueresearchonline.com

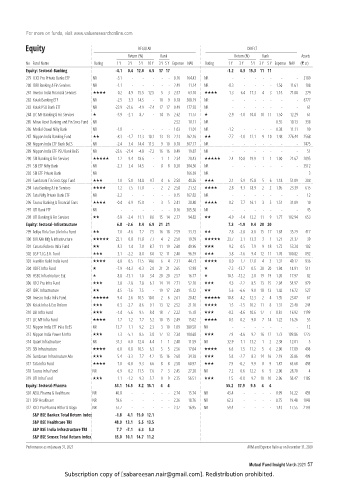

Equity REGULAR DIRECT

Return (%) Rank Return (%) Rank Assets

No Fund Name Rating 1 Y 3 Y 5 Y 10 Y 3 Y 5 Y Expense NAV Rating 1 Y 3 Y 5 Y 3 Y 5 Y Expense NAV (` cr)

Equity: Sectoral-Banking -4.1 0.4 12.0 6.5 17 17 -1.2 4.3 15.3 11 11

279 ICICI Pru Private Banks ETF NR -3.1 - - - - - 0.16 164.43 NR - - - - - - - 2189

280 IDBI Banking & Fin Services NR -1.1 - - - - - 2.49 11.14 NR -0.3 - - - - 1.56 11.61 108

281 Invesco India Financial Services 0.2 4.9 15.5 12.5 5 3 2.57 63.10 1.3 6.4 17.3 4 3 1.15 71.00 279

282 Kotak Banking ETF NR -2.5 3.3 14.5 - 10 9 0.18 308.19 NR - - - - - - - 6777

283 Kotak PSU Bank ETF NR -23.9 -21.6 -4.9 -7.4 17 17 0.49 177.92 NR - - - - - - - 61

284 LIC MF Banking & Fin Services -3.9 -2.1 8.7 - 14 15 2.62 11.57 -2.9 -1.0 10.0 10 11 1.50 12.29 61

285 Mirae Asset Banking and Fin Srvcs Fund NR - - - - - - 2.52 10.11 NR - - - - - 0.55 10.13 338

286 Motilal Oswal Nifty Bank NR -1.8 - - - - - 1.03 11.01 NR -1.2 - - - - 0.38 11.11 90

287 Nippon India Banking Fund -8.3 -1.7 11.3 10.1 13 13 2.23 262.16 -7.7 -1.0 12.1 9 10 1.48 276.44 2568

288 Nippon India ETF Bank BeES NR -2.4 3.4 14.4 11.5 9 10 0.18 307.17 NR - - - - - - - 7475

289 Nippon India ETF PSU Bank BeES NR -23.6 -21.4 -4.8 -7.2 16 16 0.49 19.87 NR - - - - - - - 51

290 SBI Banking & Fin Services 1.2 9.4 18.6 - 1 1 2.34 20.43 2.4 10.8 19.9 1 1 1.00 21.67 2095

291 SBI ETF Nifty Bank NR -2.3 3.4 14.5 - 8 8 0.20 304.56 NR - - - - - - - 3512

292 SBI ETF Private Bank NR - - - - - - - 166.69 NR - - - - - - - 3

293 Sundaram Fin Srvcs Opp Fund 1.0 5.0 14.8 9.7 4 6 2.58 48.26 2.1 5.9 15.8 5 6 1.18 51.09 288

294 Tata Banking & Fin Services 1.2 7.5 17.0 - 2 2 2.58 21.52 2.8 9.3 18.9 2 2 1.05 23.39 615

295 Tata Nifty Private Bank ETF NR -2.2 - - - - - 0.15 167.82 NR - - - - - - - 12

296 Taurus Banking & Financial Srvcs -0.4 6.9 15.0 - 3 5 2.41 28.80 0.2 7.7 16.1 3 5 1.51 31.09 10

297 UTI Bank ETF NR - - - - - - 0.16 305.50 NR - - - - - - - 45

298 UTI Banking & Fin Services -5.8 -2.4 11.1 8.6 15 14 2.77 94.82 -4.9 -1.4 12.2 11 9 1.77 102.94 653

Equity: Sectoral-Infrastructure 6.8 -2.6 8.4 6.9 21 21 7.3 -1.9 9.4 20 20

299 Aditya Birla Sun Life Infra Fund 7.0 -4.6 7.2 7.5 16 18 2.59 33.23 7.8 -3.8 8.0 15 17 1.84 35.29 417

300 BOI AXA Mfg & Infrastructure 22.1 0.8 11.8 7.7 4 2 2.50 19.39 23.7 2.1 13.3 3 1 1.21 21.37 39

301 Canara Robeco Infra Fund 8.3 -1.4 7.0 8.7 11 19 2.60 49.96 9.2 -0.5 7.9 9 18 1.72 53.24 102

302 DSP T.I.G.E.R. Fund 3.1 -2.2 8.8 8.0 12 11 2.40 96.39 3.8 -1.6 9.4 12 11 1.76 100.82 892

303 Franklin Build India Fund 6.8 0.5 11.5 14.6 6 4 2.31 44.73 8.0 1.7 12.8 4 3 1.32 49.12 936

304 HDFC Infra Fund -7.9 -14.3 -0.3 2.0 21 21 2.65 13.98 -7.3 -13.7 0.5 20 20 1.94 14.91 511

305 HSBC Infrastructure Eqt 8.8 -13.1 1.0 3.4 20 20 2.57 16.77 10.3 -12.2 2.0 19 19 1.20 17.97 82

306 ICICI Pru Infra Fund 3.8 -2.8 7.8 6.1 14 14 2.71 52.10 4.3 -2.2 8.5 13 15 2.04 54.97 979

307 IDFC Infrastructure 4.5 -7.6 7.5 - 19 17 2.49 15.12 5.6 -6.6 9.0 18 13 1.42 16.72 527

308 Invesco India Infra Fund 9.4 2.6 10.5 10.0 2 6 2.61 20.42 10.8 4.2 12.3 2 4 1.35 23.07 67

309 Kotak Infra & Eco Reform 0.3 -2.7 8.6 9.1 13 12 2.52 21.10 1.5 -1.5 10.2 11 8 1.31 23.40 244

310 L&T Infra Fund -1.4 -5.6 9.5 8.4 18 7 2.22 15.78 -0.2 -4.6 10.6 17 7 0.87 16.92 1199

311 LIC MF Infra Fund -1.7 -1.2 7.7 5.2 10 15 2.49 15.02 -0.5 -0.2 9.0 7 14 1.22 16.26 55

312 Nippon India ETF Infra BeES NR 13.7 1.1 9.2 2.3 3 10 1.09 380.58 NR - - - - - - - 12

313 Nippon India Power & Infra 7.3 -5.1 8.5 3.8 17 13 2.34 104.68 7.9 -4.6 9.2 16 12 1.73 109.86 1225

314 Quant Infrastructure NR 31.3 6.0 12.4 4.4 1 1 2.48 11.59 NR 32.9 7.1 13.2 1 2 2.38 12.01 5

315 SBI Infrastructure 6.0 0.8 10.5 6.3 5 5 2.56 17.04 6.6 1.5 11.2 5 6 2.00 17.89 498

316 Sundaram Infrastructure Adv 5.4 -3.3 7.7 4.2 15 16 2.60 34.38 5.8 -2.7 8.3 14 16 2.19 35.86 499

317 Tata Infra Fund 7.0 -0.8 9.3 6.6 8 8 2.58 60.97 7.9 -0.2 9.9 8 9 1.87 63.68 498

318 Taurus Infra Fund NR 6.9 0.2 11.5 7.6 7 3 2.45 27.28 NR 7.2 0.6 12.2 6 5 2.00 28.70 4

319 UTI Infra Fund 1.1 -1.2 9.3 5.7 9 9 2.35 56.51 1.5 -0.8 9.7 10 10 2.06 58.47 1185

Equity: Sectoral-Pharma 53.1 16.5 8.2 15.1 4 4 55.2 17.9 9.5 4 4

320 ABSL Pharma & Healthcare NR 40.8 - - - - - 2.74 15.74 NR 43.4 - - - - 0.99 16.22 459

321 DSP Healthcare NR 59.6 - - - - - 2.26 18.76 NR 62.3 - - - - 0.75 19.48 1043

322 ICICI Pru Pharma Hlthcr & Diagn NR 57.7 - - - - - 2.37 16.95 NR 59.4 - - - - 1.43 17.55 2159

S&P BSE Bankex Total Return Index -1.8 4.1 15.0 12.1

S&P BSE Healthcare TRI 48.9 13.1 5.5 13.5

S&P BSE India Infrastructure TRI 7.7 -7.1 6.3 5.3

S&P BSE Sensex Total Return Index 15.0 10.1 14.7 11.2

Performance as on January 31, 2021 AUM and Expense Ratio as on December 31, 2020

Mutual Fund Insight March 2021 57

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.