Page 63 - mutual-fund-insight - Mar 2021_Neat

P. 63

For more on funds, visit www.valueresearchonline.com

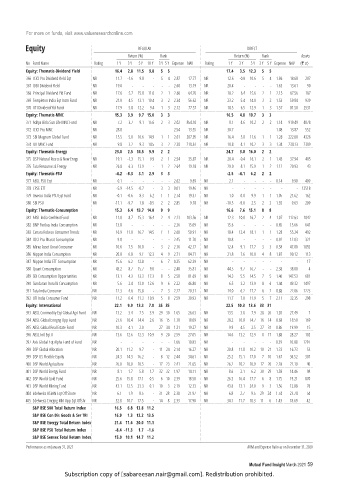

Equity REGULAR DIRECT

Return (%) Rank Return (%) Rank Assets

No Fund Name Rating 1 Y 3 Y 5 Y 10 Y 3 Y 5 Y Expense NAV Rating 1 Y 3 Y 5 Y 3 Y 5 Y Expense NAV (` cr)

Equity: Thematic-Dividend Yield 16.4 2.8 11.5 9.8 5 5 17.4 3.5 12.3 5 5

366 ICICI Pru Dividend Yield Eqt NR 11.7 -1.6 9.8 - 5 4 2.87 17.77 NR 12.6 -0.8 10.6 5 4 1.86 18.68 207

367 IDBI Dividend Yield NR 19.0 - - - - - 2.60 13.19 NR 20.4 - - - - 1.63 13.61 90

368 Principal Dividend Yld Fund NR 17.6 5.7 15.0 11.0 2 1 2.60 64.76 NR 18.2 6.4 15.6 2 1 2.15 67.56 187

369 Templeton India Eqt Incm Fund NR 21.8 4.5 13.1 10.4 3 2 2.34 56.62 NR 23.2 5.4 14.0 3 2 1.53 59.84 939

370 UTI Dividend Yld Fund NR 17.9 5.8 12.2 9.4 1 3 2.12 77.57 NR 18.5 6.5 12.9 1 3 1.57 81.50 2531

Equity: Thematic-MNC 15.3 3.9 9.7 15.0 3 3 16.5 4.8 10.7 3 3

371 Aditya Birla Sun Life MNC Fund NR 7.2 3.7 9.1 15.6 2 3 2.02 854.10 NR 8.1 4.6 10.2 2 2 1.14 919.49 4078

372 ICICI Pru MNC NR 28.8 - - - - - 2.54 13.55 NR 30.7 - - - - 1.08 13.87 552

373 SBI Magnum Global Fund NR 15.5 5.0 10.6 14.9 1 1 2.01 207.95 NR 16.4 5.8 11.6 1 1 1.28 222.00 4326

374 UTI MNC Fund NR 9.8 3.2 9.3 14.5 3 2 2.38 218.61 NR 10.8 4.1 10.2 3 3 1.34 234.13 2309

Equity: Thematic-Energy 23.0 2.5 14.5 9.9 2 2 24.7 3.8 16.0 2 2

375 DSP Natural Resrcs & New Enrgy NR 19.1 -1.3 15.1 9.9 2 1 2.54 35.87 NR 20.4 -0.4 16.1 2 1 1.43 37.94 405

376 Tata Resources & Energy NR 26.8 6.3 13.9 - 1 2 2.64 19.18 NR 29.0 8.1 15.9 1 2 1.12 20.93 43

Equity: Thematic-PSU -4.2 -8.3 3.1 2.9 3 3 -2.5 -4.1 6.2 2 2

377 ABSL PSU Eqt NR 0.1 - - - - - 2.62 9.69 NR 2.1 - - - - 0.14 9.90 409

378 CPSE ETF NR -5.9 -14.5 -0.7 - 3 3 0.01 19.46 NR - - - - - - - 12518

379 Invesco India PSU Eqt Fund NR -0.1 -0.6 8.3 6.2 1 1 2.74 19.37 NR 1.0 0.8 9.9 1 1 1.05 21.62 162

380 SBI PSU NR -11.1 -9.7 1.8 -0.5 2 2 2.85 9.18 NR -10.5 -9.0 2.5 2 2 1.92 9.63 209

Equity: Thematic-Consumption 15.3 6.4 13.7 14.0 9 9 16.6 7.6 15.1 8 8

381 ABSL India GenNext Fund NR 11.0 8.7 15.3 16.4 2 4 2.23 103.56 NR 12.3 10.0 16.7 2 4 1.07 112.63 1842

382 BNP Paribas India Consumption NR 13.8 - - - - - 2.36 15.09 NR 15.6 - - - - 0.85 15.66 641

383 Canara Robeco Consumer Trends NR 16.9 11.0 16.7 14.5 1 1 2.60 50.91 NR 18.4 12.4 18.1 1 1 1.28 55.24 492

384 ICICI Pru Bharat Consumption NR 9.0 - - - - - 2.45 11.70 NR 10.8 - - - - 0.92 12.03 322

385 Mirae Asset Great Consumer NR 10.6 7.5 16.0 - 3 2 2.16 42.17 NR 12.4 9.1 17.7 3 3 0.58 47.00 1092

386 Nippon India Consumption NR 20.8 6.8 9.1 12.3 4 9 2.71 84.71 NR 21.8 7.6 10.0 4 8 1.87 90.12 113

387 Nippon India ETF Consumption NR 15.6 6.2 12.8 - 6 7 0.35 62.39 NR - - - - - - - 17

388 Quant Consumption NR 43.2 8.7 15.7 9.0 - - 2.48 35.81 NR 44.5 9.7 16.7 - - 2.38 38.00 4

389 SBI Consumption Opportunities NR 13.1 4.3 13.3 17.3 8 5 2.58 81.69 NR 14.3 5.5 14.5 7 5 1.46 147.53 681

390 Sundaram Rural & Consumption NR 5.6 2.4 13.0 12.6 9 6 2.22 46.80 NR 6.5 3.2 13.9 8 6 1.44 49.32 1497

391 Tata India Consumer NR 12.3 4.6 15.8 - 7 3 2.27 20.31 NR 14.0 6.2 17.7 6 2 0.88 22.06 1223

392 UTI India Consumer Fund NR 11.2 6.4 11.3 10.9 5 8 2.59 30.93 NR 11.7 7.0 11.9 5 7 2.11 32.35 298

Equity: International 22.1 9.9 13.3 7.0 35 35 22.5 10.3 13.6 33 31

393 ABSL Commodity Eqt Global Agri Fund NR 13.2 3.4 7.5 3.9 29 30 1.65 26.63 NR 13.5 3.8 7.9 28 26 1.20 27.49 7

394 ABSL Global Emrgng Opp Fund NR 27.6 10.4 14.4 2.6 16 15 1.18 18.09 NR 28.2 10.8 14.7 16 14 0.68 18.50 169

395 ABSL Global Real Estate Fund NR -10.3 4.1 2.0 - 27 34 1.31 19.27 NR -9.9 4.5 2.5 27 31 0.86 19.99 15

396 ABSL Intl Eqt A NR 13.6 12.6 12.3 10.9 9 20 2.59 27.05 NR 14.6 13.2 12.9 8 17 1.88 28.27 102

397 Axis Global Eqt Alpha Fund of Fund NR - - - - - - 1.66 10.83 NR - - - - - 0.39 10.88 1297

398 DSP Global Allocation NR 20.1 11.2 9.7 - 11 24 2.14 16.27 NR 20.8 11.8 10.2 10 21 1.33 16.73 53

399 DSP US Flexible Equity NR 24.3 14.3 16.2 - 8 12 2.44 34.61 NR 25.2 15.1 17.0 7 10 1.67 36.52 307

400 DSP World Agriculture NR 26.0 10.0 10.5 - 17 23 2.41 21.65 NR 26.2 10.2 10.9 17 20 2.28 22.19 40

401 DSP World Energy Fund NR 8.1 1.7 5.8 1.7 32 32 1.97 14.11 NR 8.6 2.1 6.2 30 29 1.58 14.46 98

402 DSP World Gold Fund NR 25.6 15.8 17.1 0.5 6 10 2.39 18.50 NR 26.3 16.4 17.7 6 8 1.75 19.21 870

403 DSP World Mining Fund NR 43.1 12.5 23.3 0.1 10 3 2.19 12.33 NR 43.8 13.1 24.0 9 3 1.56 12.88 76

404 Edelweiss ASEAN Eqt Off Shore NR 6.1 1.9 8.5 - 31 28 2.38 21.97 NR 6.8 2.7 9.5 29 24 1.74 23.74 54

405 Edelweiss Emrgng Mkt Opp Eqt Offshr NR 32.8 10.7 17.5 - 14 8 2.33 17.90 NR 34.1 11.7 18.3 11 6 1.43 18.69 42

S&P BSE 500 Total Return Index 16.5 6.8 13.8 11.2

S&P BSE Con Dis Goods & Ser TRI 16.9 1.3 12.2 13.5

S&P BSE Energy Total Return Index 21.4 11.6 20.0 11.1

S&P BSE PSU Total Return Index -8.4 -11.3 1.7 -1.6

S&P BSE Sensex Total Return Index 15.0 10.1 14.7 11.2

Performance as on January 31, 2021 AUM and Expense Ratio as on December 31, 2020

Mutual Fund Insight March 2021 59

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.