Page 1227 - How to Make Money in Stocks Trilogy

P. 1227

Don’t Invest Blindly: Use Charts to See the Best Time to Buy and Sell 209

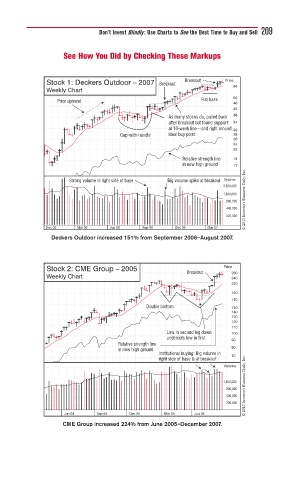

See How You Did by Checking These Markups

Breakout Price

Stock 1: Deckers Outdoor – 2007 Breakout

60

Weekly Chart

Prior uptrend Flat base 50

46

42

As many stocks do, pulled back 38

after breakout but found support 34

at 10-week line—and right around 30

Cup-with-handle ideal buy point 28

26

24

22

Relative strength line 19

in new high ground 17

© 2013 Investor’s Business Daily, Inc.

Strong volume in right side of base Big volume spike at breakout Volume

3,500,000

1,660,000

860,000

440,000

220,000

Dec 05 Mar 06 Jun 06 Sep 06 Dec 06 Mar 07

Deckers Outdoor increased 151% from September 2006–August 2007.

Stock 2: CME Group – 2005 Price

Breakout 260

Weekly Chart 240

220

190

170

Double bottom 150

140

130

120

110

Low in second leg down 100

undercuts low in first 90

Relative strength line

80

in new high ground

Institutional buying: Big volume in 70

© 2013 Investor’s Business Daily, Inc.

right side of base & at breakout

Volume

1,600,000

800,000

400,000

200,000

Jun 04 Sep 04 Dec 04 Mar 05 Jun 05

CME Group increased 224% from June 2005–December 2007.