Page 1231 - How to Make Money in Stocks Trilogy

P. 1231

Don’t Invest Blindly: Use Charts to See the Best Time to Buy and Sell 213

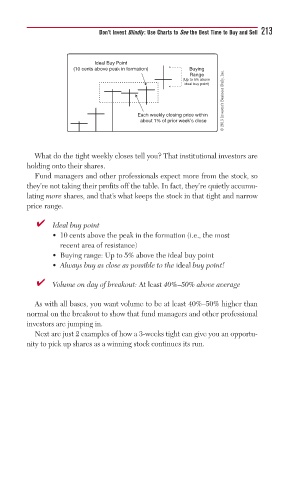

Ideal Buy Point

(10 cents above peak in formation) Buying

© 2013 Investor’s Business Daily, Inc.

Range

(Up to 5% above

ideal buy point)

Each weekly closing price within

about 1% of prior week’s close

What do the tight weekly closes tell you? That institutional investors are

holding onto their shares.

Fund managers and other professionals expect more from the stock, so

they’re not taking their profits off the table. In fact, they’re quietly accumu-

lating more shares, and that’s what keeps the stock in that tight and narrow

price range.

■ ✔ Ideal buy point

• 10 cents above the peak in the formation (i.e., the most

recent area of resistance)

• Buying range: Up to 5% above the ideal buy point

• Always buy as close as possible to the ideal buy point!

■ ✔ Volume on day of breakout: At least 40%–50% above average

As with all bases, you want volume to be at least 40%–50% higher than

normal on the breakout to show that fund managers and other professional

investors are jumping in.

Next are just 2 examples of how a 3-weeks tight can give you an opportu-

nity to pick up shares as a winning stock continues its run.