Page 245 - How to Make Money in Stocks Trilogy

P. 245

How to Read Charts Like a Pro and Improve Your Selection and Timing 127

eBay Price

140

Weekly Chart 120

100

80

70

60

Buy point is after shake-

3 weeks of fk out at D turns back up 50

g tight closesec by 3 points higher than

low price at B 40

A A 34

C C F Follow-up buy pointll wo b buy p i tt

from e e 30

from 7-week flat bas7 week flat basaeek fla7o

26

B B 22

D

19

S Second bottom at Dtond

undercuts e e e 16

undercuts below first onebelow first onew firstbdercu

at B and reverses up toB and reverses up toes up vB and

at 14

c ose a pea oase ase at ee ee

close at peak for weekr weea

12

V Volume uppolume uppm

2/1

10

Volume

80,000,000

50,000,000 © 2009 Investor’s Business Daily, Inc.

30,000,000

18,000,000

Jun 2002 Sep 2002 Dec 2002 Mar 2003 Jun 2003 Sep 2003 Dec 2003 Mar 2004

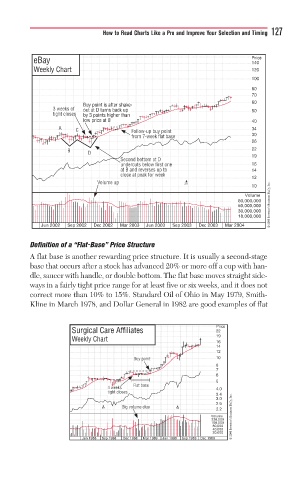

Definition of a “Flat-Base” Price Structure

A flat base is another rewarding price structure. It is usually a second-stage

base that occurs after a stock has advanced 20% or more off a cup with han-

dle, saucer with handle, or double bottom. The flat base moves straight side-

ways in a fairly tight price range for at least five or six weeks, and it does not

correct more than 10% to 15%. Standard Oil of Ohio in May 1979, Smith -

Kline in March 1978, and Dollar General in 1982 are good examples of flat

Price

Surgical Care Affiliates 22

19

Weekly Chart 16

14

12

Buy

Buy point 10

Buy pointtpointn

8

7

6

5

F Flat baseeb

4

4 4 weeks

4 eekseekseeks 4.0

tigh

tight closesht clo

3.4

3.0

2.6

Big volume cluee clu vol

Big volume clue

5/4 3/2

2.2

Volume © 2009 Investor’s Business Daily, Inc.

320,000

160,000

80,000

40,000

20,000

Jun 1988 Sep 1988 Dec 1988 Mar 1989 Jun 1989 Sep 1989 Dec 1989