Page 147 - Account 10

P. 147

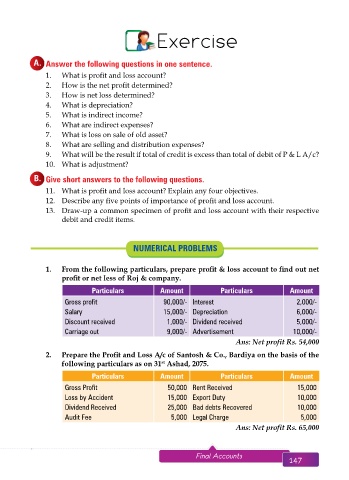

Exercise

A. Answer the following questions in one sentence.

1. What is profit and loss account?

2. How is the net profit determined?

3. How is net loss determined?

4. What is depreciation?

5. What is indirect income?

6. What are indirect expenses?

7. What is loss on sale of old asset?

8. What are selling and distribution expenses?

9. What will be the result if total of credit is excess than total of debit of P & L A/c?

10. What is adjustment?

B. Give short answers to the following questions.

11. What is profit and loss account? Explain any four objectives.

12. Describe any five points of importance of profit and loss account.

13. Draw-up a common specimen of profit and loss account with their respective

debit and credit items.

NUMERICAL PROBLEMS

1. From the following particulars, prepare profit & loss account to find out net

profit or net less of Roj & company.

Particulars Amount Particulars Amount

Gross profit 90,000/- Interest 2,000/-

Salary 15,000/- Depreciation 6,000/-

Discount received 1,000/- Dividend received 5,000/-

Carriage out 9,000/- Advertisement 10,000/-

Ans: Net profit Rs. 54,000

2. Prepare the Profit and Loss A/c of Santosh & Co., Bardiya on the basis of the

following particulars as on 31 Ashad, 2075.

st

Particulars Amount Particulars Amount

Gross Profit 50,000 Rent Received 15,000

Loss by Accident 15,000 Export Duty 10,000

Dividend Received 25,000 Bad debts Recovered 10,000

Audit Fee 5,000 Legal Charge 5,000

Ans: Net profit Rs. 65,000

146 Aakar’s Office Practice and Accountancy - 10 Final Accounts 147