Page 146 - Account 10

P. 146

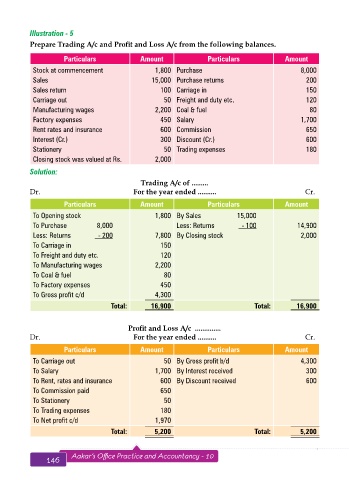

Illustration - 5

Prepare Trading A/c and Profit and Loss A/c from the following balances.

Particulars Amount Particulars Amount

Stock at commencement 1,800 Purchase 8,000

Sales 15,000 Purchase returns 200

Sales return 100 Carriage in 150

Carriage out 50 Freight and duty etc. 120

Manufacturing wages 2,200 Coal & fuel 80

Factory expenses 450 Salary 1,700

Rent rates and insurance 600 Commission 650

Interest (Cr.) 300 Discount (Cr.) 600

Stationery 50 Trading expenses 180

Closing stock was valued at Rs. 2,000

Solution:

Trading A/c of .........

Dr. For the year ended .......... Cr.

Particulars Amount Particulars Amount

To Opening stock 1,800 By Sales 15,000

To Purchase 8,000 Less: Returns - 100 14,900

Less: Returns - 200 7,800 By Closing stock 2,000

To Carriage in 150

To Freight and duty etc. 120

To Manufacturing wages 2,200

To Coal & fuel 80

To Factory expenses 450

To Gross profit c/d 4,300

Total: 16,900 Total: 16,900

Profit and Loss A/c ..............

Dr. For the year ended .......... Cr.

Particulars Amount Particulars Amount

To Carriage out 50 By Gross profit b/d 4,300

To Salary 1,700 By Interest received 300

To Rent, rates and insurance 600 By Discount received 600

To Commission paid 650

To Stationery 50

To Trading expenses 180

To Net profit c/d 1,970

Total: 5,200 Total: 5,200

146 Aakar’s Office Practice and Accountancy - 10 Final Accounts 147