Page 145 - Account 10

P. 145

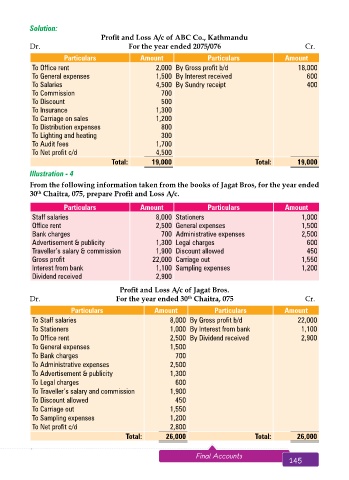

Solution:

Profit and Loss A/c of ABC Co., Kathmandu

Dr. For the year ended 2075/076 Cr.

Particulars Amount Particulars Amount

To Office rent 2,000 By Gross profit b/d 18,000

To General expenses 1,500 By Interest received 600

To Salaries 4,500 By Sundry receipt 400

To Commission 700

To Discount 500

To Insurance 1,300

To Carriage on sales 1,200

To Distribution expenses 800

To Lighting and heating 300

To Audit fees 1,700

To Net profit c/d 4,500

Total: 19,000 Total: 19,000

Illustration - 4

From the following information taken from the books of Jagat Bros, for the year ended

30 Chaitra, 075, prepare Profit and Loss A/c.

th

Particulars Amount Particulars Amount

Staff salaries 8,000 Stationers 1,000

Office rent 2,500 General expenses 1,500

Bank charges 700 Administrative expenses 2,500

Advertisement & publicity 1,300 Legal charges 600

Traveller’s salary & commission 1,900 Discount allowed 450

Gross profit 22,000 Carriage out 1,550

Interest from bank 1,100 Sampling expenses 1,200

Dividend received 2,900

Profit and Loss A/c of Jagat Bros.

Dr. For the year ended 30 Chaitra, 075 Cr.

th

Particulars Amount Particulars Amount

To Staff salaries 8,000 By Gross profit b/d 22,000

To Stationers 1,000 By Interest from bank 1,100

To Office rent 2,500 By Dividend received 2,900

To General expenses 1,500

To Bank charges 700

To Administrative expenses 2,500

To Advertisement & publicity 1,300

To Legal charges 600

To Traveller’s salary and commission 1,900

To Discount allowed 450

To Carriage out 1,550

To Sampling expenses 1,200

To Net profit c/d 2,800

Total: 26,000 Total: 26,000

144 Aakar’s Office Practice and Accountancy - 10 Final Accounts 145