Page 149 - Account 10

P. 149

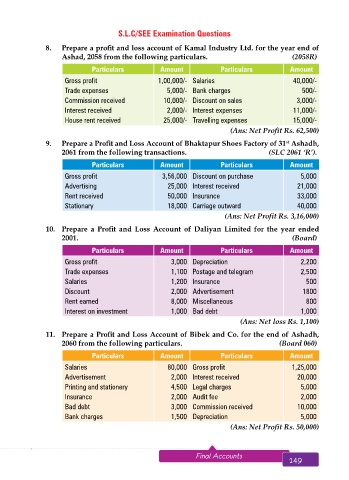

S.L.C/SEE Examination Questions

8. Prepare a profit and loss account of Kamal Industry Ltd. for the year end of

Ashad, 2058 from the following particulars. (2058R)

Particulars Amount Particulars Amount

Gross profit 1,00,000/- Salaries 40,000/-

Trade expenses 5,000/- Bank charges 500/-

Commission received 10,000/- Discount on sales 3,000/-

Interest received 2,000/- Interest expenses 11,000/-

House rent received 25,000/- Travelling expenses 15,000/-

(Ans: Net Profit Rs. 62,500)

9. Prepare a Profit and Loss Account of Bhaktapur Shoes Factory of 31 Ashadh,

st

2061 from the following transactions. (SLC 2061 ‘R’).

Particulars Amount Particulars Amount

Gross profit 3,56,000 Discount on purchase 5,000

Advertising 25,000 Interest received 21,000

Rent received 50,000 Insurance 33,000

Stationary 18,000 Carriage outward 40,000

(Ans: Net Profit Rs. 3,16,000)

10. Prepare a Profit and Loss Account of Daliyan Limited for the year ended

2001. (Board)

Particulars Amount Particulars Amount

Gross profit 3,000 Depreciation 2,200

Trade expenses 1,100 Postage and telegram 2,500

Salaries 1,200 Insurance 500

Discount 2,000 Advertisement 1800

Rent earned 8,000 Miscellaneous 800

Interest on investment 1,000 Bad debt 1,000

(Ans: Net loss Rs. 1,100)

11. Prepare a Profit and Loss Account of Bibek and Co. for the end of Ashadh,

2060 from the following particulars. (Board 060)

Particulars Amount Particulars Amount

Salaries 80,000 Gross profit 1,25,000

Advertisement 2,000 Interest received 20,000

Printing and stationery 4,500 Legal charges 5,000

Insurance 2,000 Audit fee 2,000

Bad debt 3,000 Commission received 10,000

Bank charges 1,500 Depreciation 5,000

(Ans: Net Profit Rs. 50,000)

148 Aakar’s Office Practice and Accountancy - 10 Final Accounts 149