Page 127 - Office Practice and Accounting -9

P. 127

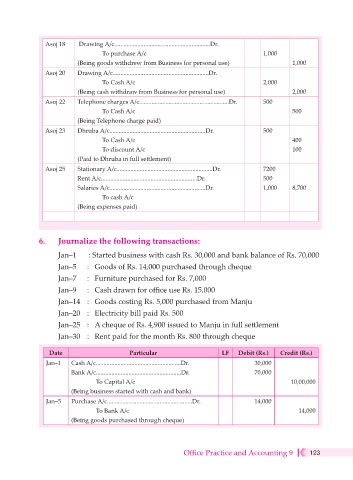

Asoj 18 Drawing A/c..............................................................Dr.

To purchase A/c 1,000

(Being goods withdrew from Business for personal use) 1,000

Asoj 20 Drawing A/c..............................................................Dr.

To Cash A/c 2,000

(Being cash withdraw from Business for personal use) 2,000

Asoj 22 Telephone charges A/c..........................................................Dr. 500

To Cash A/c 500

(Being Telephone charge paid)

Asoj 23 Dhruba A/c..............................................................Dr. 500

To Cash A/c 400

To discount A/c 100

(Paid to Dhruba in full settlement)

Asoj 25 Stationary A/c..............................................................Dr. 7200

Rent A/c..............................................................Dr. 500

Salaries A/c..............................................................Dr. 1,000 8,700

To cash A/c

(Being expenses paid)

6. Journalize the following transactions:

Jan–1 : Started business with cash Rs. 30,000 and bank balance of Rs. 70,000

Jan–5 : Goods of Rs. 14,000 purchased through cheque

Jan–7 : Furniture purchased for Rs. 7,000

Jan–9 : Cash drawn for office use Rs. 15,000

Jan–14 : Goods costing Rs. 5,000 purchased from Manju

Jan–20 : Electricity bill paid Rs. 500

Jan–25 : A cheque of Rs. 4,900 issued to Manju in full settlement

Jan–30 : Rent paid for the month Rs. 800 through cheque

Date Particular LF Debit (Rs.) Credit (Rs.)

Jan–1 Cash A/c.......................................................Dr. 30,000

Bank A/c.......................................................Dr. 70,000

To Capital A/c 10,00,000

(Being business started with cash and bank)

Jan–5 Purchase A/c.......................................................Dr. 14,000

To Bank A/c 14,000

(Being goods purchased through cheque)

Office Practice and Accounting 9 123